Business, 29.01.2021 17:30 haleyllevsen

The demand for toys produced by the Miki Manufacturing Company has been collected in the Microsoft Excel Online file below. Use the Microsoft Excel Online file below to develop simple linear regression forecast and answer the following questions.

Simple Linear Regression Forecast

Period Actual Demand Forecast Formulas

1 1,600 #N/A

2 2,000 #N/A

3 1,800 #N/A

4 1,200 #N/A

5 2,300 #N/A

6 3,600 #N/A

7 3,300 #N/A

8 3,200 #N/A

9 4,000 #N/A

10 4,900 #N/A

11 4,500 #N/A

12 4,400 #N/A

13 #N/A

Intercept #N/A

Slope #N/A

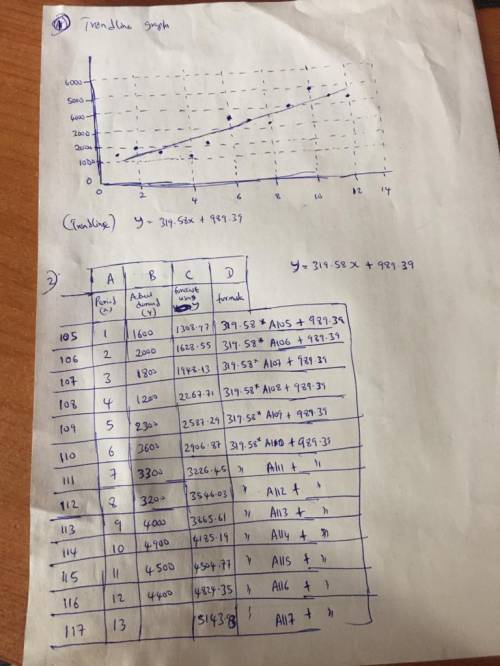

1. What is the trend line? Round your answers to two decimal places. Do not round intermediate calculations.

2. Calculate the linear trend forecast for the periods from 1 to 13. Round your answers to the nearest whole number. Use unrounded intercept and slope values.

Period Forecast

1

2

3

4

5

6

7

8

9

10

11

12

13

Answers: 1

Another question on Business

Business, 21.06.2019 21:20

Vital industries manufactured 2 comma 200 units of its product huge in the month of april. it incurred a total cost of $ 121 comma 000 during the month. out of this $ 121 comma 000, $ 46 comma 000 comprised of direct materials used in the product and the rest was incurred because of the conversion cost involved in the process. ryan had no opening or closing inventory. what will be the total cost per unit of the product, assuming conversion costs contained $ 10 comma 900 of indirect labor?

Answers: 1

Business, 21.06.2019 22:30

Match the vocabulary word to the correct definition. 1. human resources department 2. job description 3. ethics 4. labor relations 5. occupational safety & health administration a. a detailed list of the functions and requirements for a position b. the exchange between the employer and employee c. principles that define appropriate conduct d. the government agency responsible for monitoring safety in the workplace e. the division of a business responsible for hiring, managing,maintaining, and firing the workforce

Answers: 1

Business, 22.06.2019 16:20

Suppose you hold a portfolio consisting of a $10,000 investment in each of 8 different common stocks. the portfolio's beta is 1.25. now suppose you decided to sell one of your stocks that has a beta of 1.00 and to use the proceeds to buy a replacement stock with a beta of 1.55. what would the portfolio's new beta be? do not round your intermediate calculations.

Answers: 2

Business, 22.06.2019 20:20

Tl & co. is following a related-linked diversification strategy, and soar inc. is following a related-constrained diversification strategy. how do the two firms differ from each other? a. soar inc. generates 70 percent of its revenues from its primary business, while tl & co. generates only 10 percent of its revenues from its primary business. b. soar inc. pursues a backward diversification strategy, while tl & co. pursues a forward diversification strategy. c. tl & co. will share fewer common competencies and resources between its various businesses when compared to soar inc. d. tl & co. pursues a differentiation strategy, and soar inc. pursues a cost-leadership strategy, to gain a competitive advantage.

Answers: 3

You know the right answer?

The demand for toys produced by the Miki Manufacturing Company has been collected in the Microsoft E...

Questions

Chemistry, 02.10.2019 21:00

Chemistry, 02.10.2019 21:00

Chemistry, 02.10.2019 21:00

Chemistry, 02.10.2019 21:00

Chemistry, 02.10.2019 21:00

Mathematics, 02.10.2019 21:00

Mathematics, 02.10.2019 21:00

Computers and Technology, 02.10.2019 21:00