Business, 11.03.2020 03:02 ariannapenny98

Whitney received $75,000 of taxable income in 2017. All of the income was salary from her employer. What is her income tax liability in each of the following alternative situations? Use Tax Rate Schedule for reference. (Do not round intermediate calculations. Round your answer to 2 decimal places.)

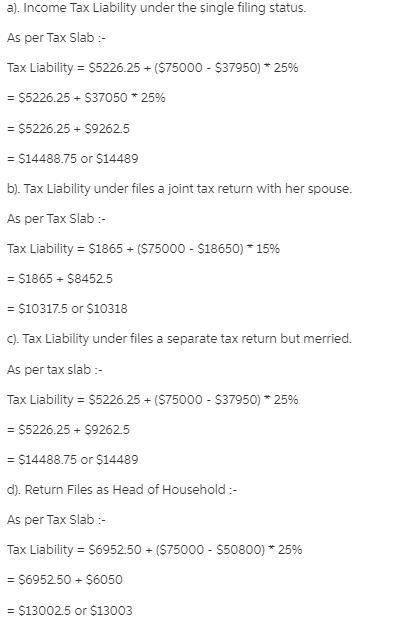

a. She files under the single filing status.

b. She files a joint tax return with her spouse. Together their taxable income is $75,000.

c. She is married but files a separate tax return. Her taxable income is $75,000.

d. She files as a head of household.

Answers: 3

Another question on Business

Business, 22.06.2019 17:50

What additional information about the numbers used to compute this ratio might be useful in you assess liquidity? (select all that apply) (a) the maturity schedule of current liabilities (b) the average stock price for the industry (c) the average current ratio for the industry (d) the amount of current assets that is concentrated in relatively illiquid inventories

Answers: 3

Business, 22.06.2019 20:00

Because this market is a monopolistically competitive market, you can tell that it is in long-run equilibrium by the fact thatmr=mc at the optimal quantity for each firm. furthermore, a monopolistically competitive firm's average total cost in long-run equilibrium isless than the minimum average total cost. true or false: this indicates that there is a markup on marginal cost in the market for engines. true false monopolistic competition may also be socially inefficient because there are too many or too few firms in the market. the presence of the externality implies that there is too little entry of new firms in the market.

Answers: 3

Business, 22.06.2019 21:50

Varto company has 9,400 units of its sole product in inventory that it produced last year at a cost of $23 each. this year’s model is superior to last year’s, and the 9,400 units cannot be sold at last year’s regular selling price of $42 each. varto has two alternatives for these items: (1) they can be sold to a wholesaler for $8 each, or (2) they can be reworked at a cost of $251,100 and then sold for $34 each. prepare an analysis to determine whether varto should sell the products as is or rework them and then sell them.

Answers: 2

Business, 23.06.2019 04:00

Match the different taxes to the levels at which these taxes are levied on consumers and businesses national level/ national and local levels 1.sales tax 2.income tax 3.payroll tax 4.social security tax 4.property tax

Answers: 1

You know the right answer?

Whitney received $75,000 of taxable income in 2017. All of the income was salary from her employer....

Questions

Mathematics, 29.06.2020 15:01

English, 29.06.2020 15:01

Mathematics, 29.06.2020 15:01

Mathematics, 29.06.2020 15:01

Biology, 29.06.2020 15:01

Mathematics, 29.06.2020 15:01

Mathematics, 29.06.2020 15:01

Mathematics, 29.06.2020 15:01

Biology, 29.06.2020 15:01

Spanish, 29.06.2020 15:01

English, 29.06.2020 15:01

Mathematics, 29.06.2020 15:01

Chemistry, 29.06.2020 15:01

Chemistry, 29.06.2020 15:01

Computers and Technology, 29.06.2020 15:01

History, 29.06.2020 15:01