Mathematics, 12.03.2022 14:00 juniorvalencia4

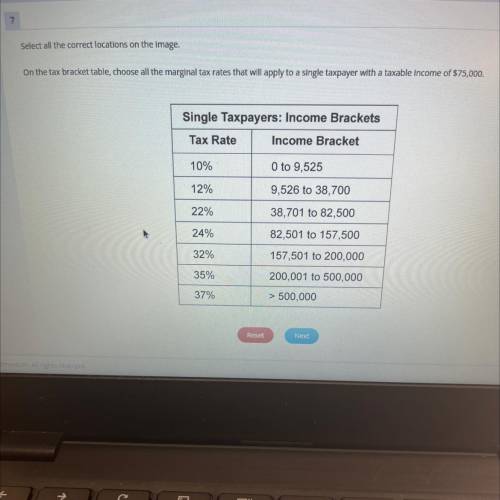

On the tax bracket table, choose all the marginal tax rates that will apply to a single taxpayer with a taxable income of $75,000.

Single Taxpayers: Income Brackets

Tax Rate

Income Bracket

10%

O to 9,525

12%

9,526 to 38,700

22%

38,701 to 82,500

24%

82,501 to 157,500

32%

157,501 to 200,000

35%

200,001 to 500,000

37%

> 500,000

Reset

Next

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 18:30

Atriangle with all sides of equal length is a/an triangle. a. right b. scalene c. equilateral d. isosceles

Answers: 2

Mathematics, 21.06.2019 18:30

In the diagram below? p is circumscribed about quadrilateral abcd. what is the value of x

Answers: 1

Mathematics, 21.06.2019 18:30

How do you create a data set with 8 points in it that has a mean of approximately 10 and a standard deviation of approximately 1?

Answers: 1

Mathematics, 21.06.2019 20:00

What are the domain and range of the function f(x)=2^x+1

Answers: 1

You know the right answer?

On the tax bracket table, choose all the marginal tax rates that will apply to a single taxpayer wit...

Questions

Computers and Technology, 20.12.2019 03:31

Mathematics, 20.12.2019 03:31

Chemistry, 20.12.2019 03:31

Computers and Technology, 20.12.2019 03:31