Mathematics, 28.01.2020 03:31 bighomie28

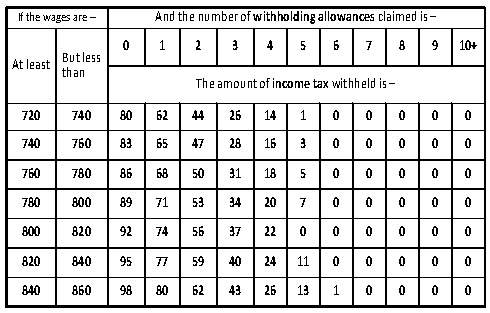

Marilyn has a biweekly gross pay of $810 and claims 3 federal withholding allowances. marilyn has all of the following deductions from her gross pay:

federal tax from the following table

2007-02-03-00-00_files/i019.jpg

social security tax that is 6.2% of her gross pay

medicare tax that is 1.45% of her gross pay

state tax that is 21% of her federal tax

determine how marilyn’s net pay will be affected if she increases her federal withholding allowances from 3 to 4.

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 16:40

Which region represents the solution to the given system of inequalities? |-0.5x+y23 | 1.5x+ys-1 5 4 -3 -2 -1 1 2 3 4

Answers: 1

Mathematics, 21.06.2019 18:30

Select 2 statements that are true about the equation y+6=-10(x-3).1) the slope of the line is -102) the slope of the line is 33) one point on the line is (3,6)4) one point on the line is (3,-6)

Answers: 1

Mathematics, 21.06.2019 19:30

James was playing a game with his friends. he won 35 points. then he lost 15, lost 40 and won 55. how did he come out

Answers: 2

Mathematics, 21.06.2019 20:10

Which value of m will create a system of parallel lines with no solution? y= mx - 6 8x - 4y = 12

Answers: 1

You know the right answer?

Marilyn has a biweekly gross pay of $810 and claims 3 federal withholding allowances. marilyn has al...

Questions

Computers and Technology, 12.12.2019 20:31

Chemistry, 12.12.2019 20:31