Mathematics, 08.04.2021 20:40 meaghan18

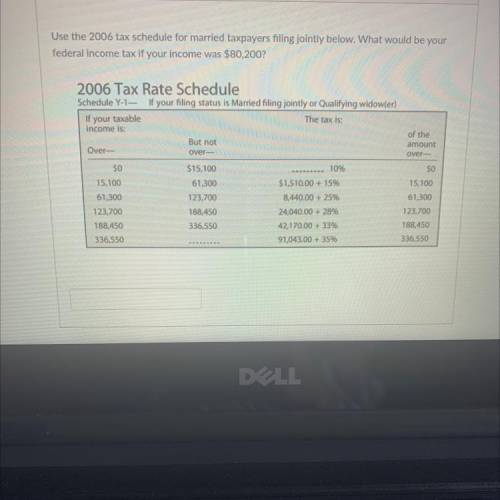

Use the 2006 tax schedule for married taxpayers filing jointly below. What would be your

federal income tax if your income was $80,200?

2006 Tax Rate Schedule

Schedule Y-1- If your filing status is Married filing jointly or Qualifying widow(er)

If your taxable

The tax is:

income is:

But not

Over-

over-

of the

amount

over-

10%

$1,510.00 + 15%

$0

15,100

61,300

123,700

188,450

336,550

$15,100

61,300

123,700

188,450

336,550

8,440.00 + 25%

24,040.00 + 28%

42,170.00 + 33%

91,043.00 + 3596

$0

15,100

61,300

123,700

188,450

336,550

M

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 18:40

That table shows measurements (in invhes$ from cubes with different side lengths. which pairs of variables have a linear relationship? check all that apply

Answers: 3

Mathematics, 22.06.2019 00:00

Find the length of the normal and the angle it makes with the positive x-axis. (see pictured below)

Answers: 1

Mathematics, 22.06.2019 00:00

What is the value of x in this triangle? a. 53° b. 62° c. 65° d. 118°

Answers: 2

You know the right answer?

Use the 2006 tax schedule for married taxpayers filing jointly below. What would be your

federal in...

Questions

English, 25.03.2020 05:25

Business, 25.03.2020 05:25

Mathematics, 25.03.2020 05:25

Mathematics, 25.03.2020 05:26

Mathematics, 25.03.2020 05:26

Biology, 25.03.2020 05:26