Mathematics, 08.04.2021 03:20 railfan98

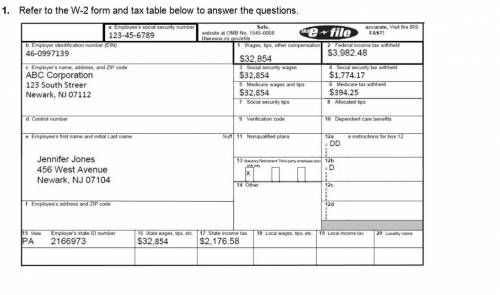

(a) What was Jennifer’s gross pay for the year?

(b) How much did she pay in federal income tax?

(c) The amount in Box 4 is incorrect. Since Social Security is a 6.2% tax, what dollar amount should have been entered in Box 4?

(d) The amount in Box 6 is incorrect. Since Medicare is a 1.45% tax, what dollar amount should have been entered in Box 6?

(e) How much was Jennifer’s FICA tax (using the corrected values from (c) and (d))?

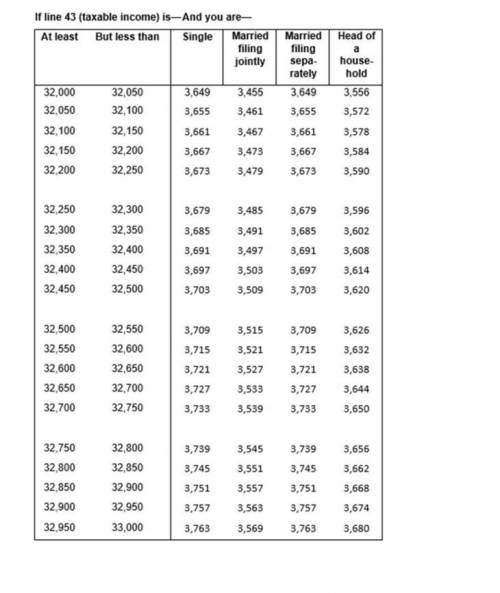

(f) Jennifer’s taxable income was $32,854. She’s filing her taxes as single. Does she owe the government more money in taxes, or will she receive a refund? How much money will she owe or receive? Explain your thinking process in your own words to earn full credit.

refer to images for help

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 18:40

A33 gram sample of a substance that's used to detect explosives has a k-value of 0.1473. n = noekt no = initial mass (at time t = 0) n = mass at time t k = a positive constant that depends on the substance itself and on the units used to measure time t = time, in days

Answers: 1

Mathematics, 21.06.2019 23:30

Solve the following: 12(x^2–x–1)+13(x^2–x–1)=25(x^2–x–1) 364x–64x=300x

Answers: 1

Mathematics, 22.06.2019 01:20

Ahyperbola centered at the origin has a vertex at (-6,0) and a focus at (10,0)

Answers: 2

You know the right answer?

(a) What was Jennifer’s gross pay for the year?

(b) How much did she pay in federal income tax?

Questions

Mathematics, 25.07.2019 12:40

Chemistry, 25.07.2019 12:40

Chemistry, 25.07.2019 12:40

Health, 25.07.2019 12:40

Mathematics, 25.07.2019 12:40

Social Studies, 25.07.2019 12:40

History, 25.07.2019 12:50

History, 25.07.2019 12:50