Mathematics, 11.03.2021 01:00 Hammon1774

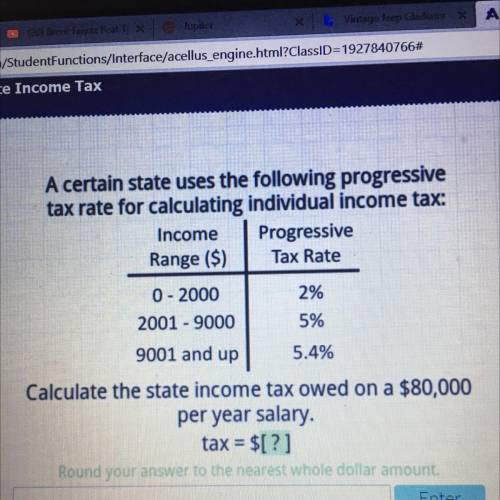

A certain state uses the following progressive

tax rate for calculating individual income tax:

Income Progressive

Range ($) Tax Rate

0 - 2000

2%

2001 - 9000 5%

9001 and up

5.4%

Calculate the state income tax owed on a $80,000

per year salary.

tax = $[?]

Round your answer to the nearest whole dollar amount.

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 21:20

Find the missing variable for a parallelogram: a = latex: 28in^2 28 i n 2 h = b = 6.3 in (1in=2.54cm)

Answers: 3

Mathematics, 21.06.2019 22:00

Worth 100 points need the answers asap first row -x^2 2x^2 (x/2)^2 x^2 x is less than 2 x is greater than 2 x is less than or equal to 2 x is greater than or equal to 2 second row -5 -5/2 4 5 •2 is less than x& x is less than 4 •2 is less than or equal to x & x is less than or equal to 4 •2 is less than or equal to x& x is less than 4 •2 is less than x& x is less than or equal to 4

Answers: 2

Mathematics, 21.06.2019 23:30

On this question. a hypothermia occurs when a person's body temperature drops below 95 degrees fahrenheit. write and solve an inequality that describes how much lower the body temperature of a person with hypothermia will be than the body temperature of a person with a normal temperature of 98.6 degrees fahrenheit

Answers: 1

You know the right answer?

A certain state uses the following progressive

tax rate for calculating individual income tax:

Questions

Mathematics, 03.10.2019 06:30

History, 03.10.2019 06:30

Social Studies, 03.10.2019 06:30

Mathematics, 03.10.2019 06:30

Business, 03.10.2019 06:30