Mathematics, 21.10.2020 14:01 Homepage10

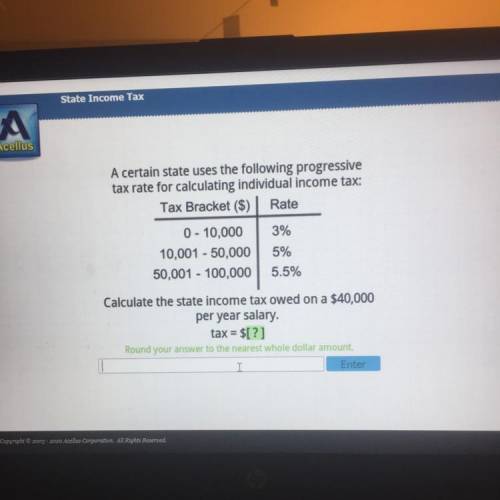

A certain state uses the following progressive

tax rate for calculating individual income tax:

Tax Bracket ($) Rate

3%

0 - 10,000

10,001 - 50,000

50,001 - 100,000

5%

5.5%

Calculate the state income tax owed on a $40,000

per year salary.

tax = $1?1

Answers: 3

Another question on Mathematics

Mathematics, 22.06.2019 00:30

Suppose that the function f is defined. , for all real numbers, as follows. _ \ 1/4x² -4 if x≠ -2 f(x)=< /_-1 if x=-2 find f(-5), f(-2), and f(4)

Answers: 3

Mathematics, 22.06.2019 01:00

The equation line of cd is y=-2x-2. write an equation of a line parallels to line cd in slope-intercept form that contains point (4,5)

Answers: 1

You know the right answer?

A certain state uses the following progressive

tax rate for calculating individual income tax:

Questions

Mathematics, 29.08.2019 19:30

Mathematics, 29.08.2019 19:30

Biology, 29.08.2019 19:30

Mathematics, 29.08.2019 19:30

Biology, 29.08.2019 19:30

English, 29.08.2019 19:30

Mathematics, 29.08.2019 19:30

Mathematics, 29.08.2019 19:30

Mathematics, 29.08.2019 19:30

History, 29.08.2019 19:30