Mathematics, 21.12.2019 07:31 zhenhe3423

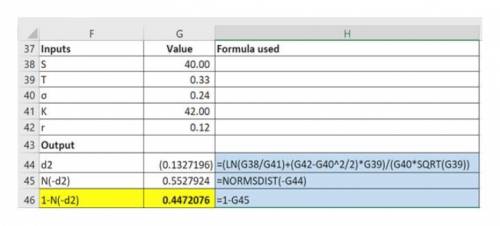

The price of a certain security follows a geometric brownian motion with drift parameter µ = 0.12 and the volatility parameter σ = 0.24.

(a) if the current price of the security is $40, find the probability that a call option, having four months until expiration and with a strike price of k = 42 will be exercised.

(b) in addition to the above information as in part (a) if the interest rate is 8%, find the risk-neutral arbitrage free valuation of the call option.

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 18:00

What does the relationship between the mean and median reveal about the shape of the data

Answers: 1

Mathematics, 21.06.2019 21:00

Me! i will mark you brainliest if you are right and show your i don't get polynomials and all the other stuff. multiply and simplify.2x(^2)y(^3)z(^2) · 4xy(^4)x(^2)show your

Answers: 2

Mathematics, 21.06.2019 21:10

Indicate the formula for the following conditions: p^c(n,r)=

Answers: 3

Mathematics, 21.06.2019 21:30

Joanie wrote a letter that was 1 1/4 pages long. katie wrote a letter that was 3/4 page shorter then joagies letter. how long was katies letter

Answers: 1

You know the right answer?

The price of a certain security follows a geometric brownian motion with drift parameter µ = 0.12 an...

Questions

Social Studies, 30.05.2020 09:58

Mathematics, 30.05.2020 09:58

English, 30.05.2020 09:58

Geography, 30.05.2020 09:58

Mathematics, 30.05.2020 09:58

Chemistry, 30.05.2020 09:58

Mathematics, 30.05.2020 09:58

Arts, 30.05.2020 09:58