Business, 08.02.2022 08:40 jjjjjjgegi3088

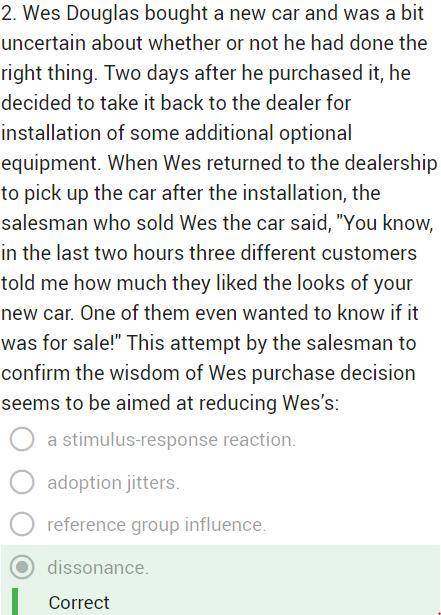

Wes Douglas bought a new car and was a bit uncertain about whether or not he had done the right thing. Two days after he purchased it, he decided to take it back to the dealer for installation of some additional optional equipment. When Wes returned to the dealership to pick up the car after the installation, the salesman who sold Wes the car said, "You know, in the last two hours three different customers told me how much they liked the looks of your new car. One of them even wanted to know if it was for sale!" This attempt by the salesman to confirm the wisdom of Wes purchase decision seems to be aimed at reducing Wes’s:

Answers: 3

Another question on Business

Business, 21.06.2019 13:00

Match the following definitions to your vocabulary words. 1. separation from a main group to form a new group as a result of disunity ethnic 2. group of people that share a distinctive race, culture, heritage, or nationality discrimination 3. removal of legal and social barriers which impose separation of groups integration 4. practice that treats equal people unequally; denial of opportunities to compete for social and economic rewards stereotyping 5. acting in a biased manner; using prejudicial thinking segregation

Answers: 3

Business, 21.06.2019 22:40

Gyou plan to deposit $1,700 per year for 5 years into a money market account with an annual return of 2%. you plan to make your first deposit one year from today. what amount will be in your account at the end of 5 years? round your answer to the nearest cent. do not round intermediate calculations. $ assume that your deposits will begin today. what amount will be in your account after 5 years? round your answer to the nearest cent. do not round intermediate calculations.

Answers: 2

Business, 22.06.2019 11:40

During 2016, nike inc., reported net income of $3,760 million. the company declared dividends of $1,022 million. the closing entry for dividends would include which of the following? select one: a. credit cash for $1,022 million b. credit dividends for $1,022 million c. debit net income for $1,022 million d. credit retained earnings for $1,022 million e. debit dividends for $1,022 million

Answers: 1

Business, 22.06.2019 18:30

Amanufacturer has paid an engineering firm $200,000 to design a new plant, and it will cost another $2 million to build the plant. in the meantime, however, the manufacturer has learned of a foreign company that offers to build an equivalent plant for $2,100,000. what should the manufacturer do?

Answers: 1

You know the right answer?

Wes Douglas bought a new car and was a bit uncertain about whether or not he had done the right thin...

Questions

English, 04.12.2020 02:30

Health, 04.12.2020 02:30

Mathematics, 04.12.2020 02:30

History, 04.12.2020 02:30

Mathematics, 04.12.2020 02:30

Chemistry, 04.12.2020 02:30

Mathematics, 04.12.2020 02:30

Chemistry, 04.12.2020 02:30