Business, 30.07.2021 04:30 anthonywdjr5211

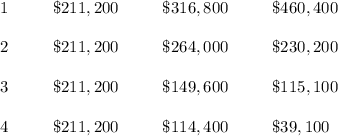

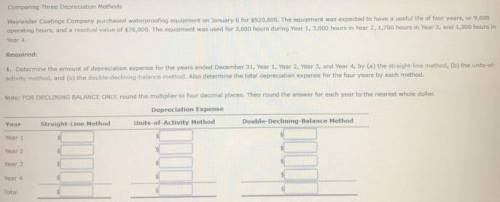

Comparing Three Depreciation Methods Waylander Coatings Company purchased waterproofing equipment on January 6 for $502,200. The equipment was expected to have a useful life of four years, or 9,600 operating hours, and a residual value of $41,400. The equipment was used for 3,600 hours during Year 1, 3,000 hours in Year 2, 1,700 hours in Year 3, and 1,300 hours in Year 4.

Required:

Determine the amount of depreciation expense for the years ended December 31, Year 1, Year 2, Year 3, and Year 4, by (a) the straight-line method, (b) the units-of-activity method, and (c) the double-declining-balance method.

Answers: 3

Another question on Business

Business, 22.06.2019 10:30

Zapper has beginning equity of $257,000, net income of $51,000, dividends of $40,000 and investments by stockholders of $6,000. its ending equity is

Answers: 2

Business, 22.06.2019 15:00

Which of the following is least likely to a team solve problems together

Answers: 1

Business, 22.06.2019 22:00

Most economists report the elasticity of demand asa. the absolute value of the actual number.b. a negative number, since price and quantity demanded move in opposite directions.c. a percentage, since both the numerator and denominator are percentages.d. a dollar amount, since we are measuring the change in price.

Answers: 2

You know the right answer?

Comparing Three Depreciation Methods Waylander Coatings Company purchased waterproofing equipment on...

Questions

Spanish, 08.12.2020 20:20

English, 08.12.2020 20:20

Health, 08.12.2020 20:20

Mathematics, 08.12.2020 20:20

Mathematics, 08.12.2020 20:20

Mathematics, 08.12.2020 20:20

History, 08.12.2020 20:20

Computers and Technology, 08.12.2020 20:20

Spanish, 08.12.2020 20:20

English, 08.12.2020 20:20

Mathematics, 08.12.2020 20:20

History, 08.12.2020 20:20

Mathematics, 08.12.2020 20:20

Mathematics, 08.12.2020 20:20