Business, 03.06.2021 17:40 brisamauro27

Melody Instruments Company had the following transactions in March:.

Sold instruments to customers for $16,300; received $11,900 in cash and the rest on account. The cost of the instruments was $7,700. Purchased $3,600 of new instruments inventory; paid $1,100 in cash and owed the rest on account. Paid $590 in wages to employees who worked during the month. Received $3,800 from customers as deposits on orders of new instruments to be sold to the customers in April. Received a $280 bill for March utilities that will be paid in April.

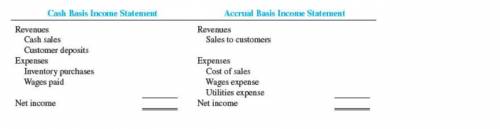

Complete the following statements: Cash Basis Income Statement Accrual Basis Income Statement Revenues Revenues Cash sales Customer deposits Sales to customers Expenses Expenses Inventory purchases Wages paid Cost of sales Wages expense Utlities expense Net income Net income

Answers: 2

Another question on Business

Business, 22.06.2019 01:30

Eliminating entries (including goodwill impairment) and worksheets for various years on january 1, 2013, porter company purchased an 80% interest in the capital stock of salem company for$850,000. at that time, salem company had capital stock of $550,000 and retained earnings of $80,000.differences between the fair value and the book value of the identifiable assets of salem company were asfollows: fair value in excess of book valueequipment$130,000land65,000inventory40,000the book values of all other assets and liabilities of salem company were equal to their fair values onjanuary 1, 2013. the equipment had a remaining life of five years on january 1, 2013. the inventory was sold in2013.salem company’s net income and dividends declared in 2013 and 2014 were as follows: year 2013 net income of $100,000; dividends declared of $25,000year 2014 net income of $110,000; dividends declared of $35,000required: a.prepare a computation and allocation schedule for the difference between book value of equity acquired andthe value implied by the purchase price.b.present the eliminating/adjusting entries needed on the consolidated worksheet for the year endeddecember 31, 2013. (it is not necessary to prepare the worksheet.)lo6lo1

Answers: 1

Business, 22.06.2019 19:40

Your father's employer was just acquired, and he was given a severance payment of $375,000, which he invested at a 7.5% annual rate. he now plans to retire, and he wants to withdraw $35,000 at the end of each year, starting at the end of this year. how many years will it take to exhaust his funds, i.e., run the account down to zero? a. 22.50 b. 23.63 c. 24.81 d. 26.05 e. 27.35

Answers: 2

Business, 22.06.2019 23:30

Sole proprietorships produce more goods and services than does any other form of business organization.

Answers: 2

Business, 23.06.2019 00:00

How do the percentages of the 65 customer satisfaction ratings in that actually fall into the intervals [formula62.mml ± s], [formula62.mml ± 2s], and [formula62.mml ± 3s] compare to those given by the empirical rule? do these comparisons indicate that the statistical inferences you made in parts b and c are reasonably valid? (round your answers to the nearest whole number. omit the "%" sign in your

Answers: 2

You know the right answer?

Melody Instruments Company had the following transactions in March:.

Sold instruments to customers...

Questions

Mathematics, 27.01.2020 18:31

Chemistry, 27.01.2020 18:31

Social Studies, 27.01.2020 18:31

Biology, 27.01.2020 18:31

Advanced Placement (AP), 27.01.2020 18:31

Biology, 27.01.2020 18:31

English, 27.01.2020 18:31

Mathematics, 27.01.2020 18:31