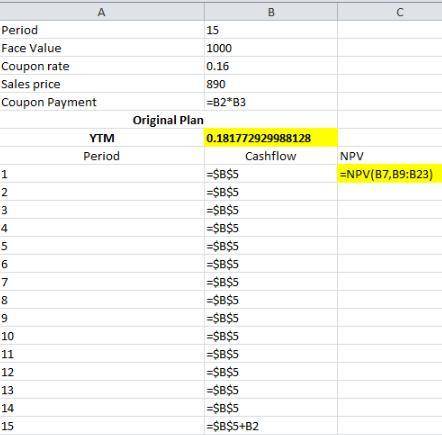

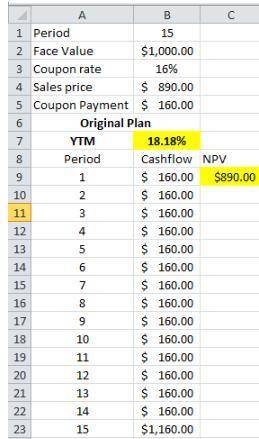

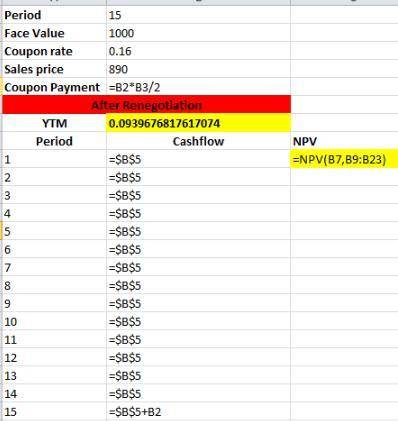

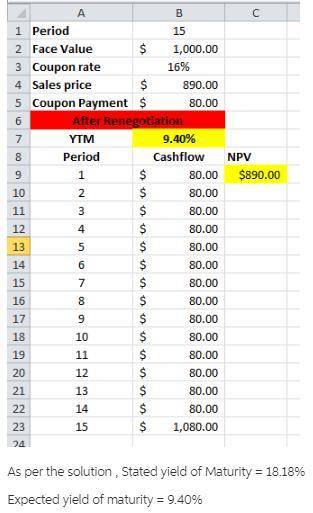

A 15-year bond of a firm in severe financial distress has a coupon rate of 16% and sells for $890. The firm is currently renegotiating the debt, and it appears that the lenders will allow the firm to reduce coupon payments on the bond to one-half the originally contracted amount. The firm can handle these lower payments. What are the stated and expected yield to maturity of the bonds? The bond makes its coupon payments annually:

Answers: 1

Another question on Business

Business, 22.06.2019 14:00

Which of the following would not generally be a motive for a firm to hold inventories? a. to decouple or separate parts of the production process b. to provide a stock of goods that will provide a selection for customers c. to take advantage of quantity discounts d. to minimize holding costs e. all of the above are functions of inventory.

Answers: 1

Business, 22.06.2019 14:30

What’s the present value of a perpetuity that pays $250 per year if the appropriate interest rate is 5%? $4,750 $5,000 $5,250 $5,513 $5,788what is the present value of the following cash flow stream at a rate of 8.0%, rounded to the nearest dollar? cash flows: today (t = 0) it is $750, after one year (t = 1) it is $2,450, at t = 2 it is $3,175, and at t=3 it is $4,400. draw a time line. $7,917 $8,333 $8,772 $9,233 $9,695

Answers: 2

Business, 22.06.2019 14:40

Nell and kirby are in the process of negotiating their divorce agreement. what should be the tax consequences to nell and kirby if the following, considered individually, became part of the agreement? a. in consideration for her one-half interest in their personal residence, kirby will transfer to nell stock with a value of $200,000 and $50,000 of cash. kirby's cost of the stock was $150,000, and the value of the personal residence is $500,000. they purchased the residence three years ago for $300,000.nell's basis for the stock is $ xkirby's basis in the house is $ xb. nell will receive $1,000 per month for 120 months. if she dies before receiving all 120 payments, the remaining payments will be made to her estate.the payments (qualify, do not qualify) as alimony and are (included in, excluded from) nell's gross income as they are received.c. nell is to have custody of their 12-year-old son, bobby. she is to receive $1,200 per month until bobby (1) dies or (2) attains age 21 (whichever occurs first). after either of these events occurs, nell will receive only $300 per month for the remainder of her life.$ x per month is alimony that is (included in, excluded from) nell's gross income, and the remaining $ x per month is considered (child support, property settlement) and is (nontaxable, taxable) to nell.

Answers: 3

Business, 22.06.2019 20:20

Why is it easier for new entrants to get involved in radical innovations when compared to incumbent firms? a. unlike incumbent firms, new entrants do not have to face the high entry barriers, initially. b. new entrants are embedded in an innovation ecosystem, while incumbent firms are not. c. unlike incumbent firms, new entrants do not have formal organizational structures and processes. d. incumbent firms do not have the advantages of network effects that new entrants have.

Answers: 2

You know the right answer?

A 15-year bond of a firm in severe financial distress has a coupon rate of 16% and sells for $890. T...

Questions

Mathematics, 11.10.2019 15:30

Arts, 11.10.2019 15:30

History, 11.10.2019 15:30

Physics, 11.10.2019 15:30

Social Studies, 11.10.2019 15:30

Mathematics, 11.10.2019 15:30

History, 11.10.2019 15:30