Income

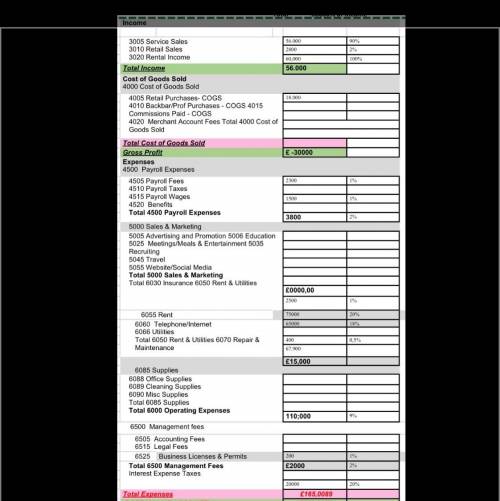

"3005 Service Sales 3010 Retail Sales 3020 Rental Income" 56.00090%

28002%

60,...

Business, 19.05.2021 01:00 oneicyahdaley10

Income

"3005 Service Sales 3010 Retail Sales 3020 Rental Income" 56.00090%

28002%

60,000100%

Total Income 56.000

"Cost of Goods Sold 4000 Cost of Goods Sold"

"4005 Retail Purchases- COGS 4010 Backbar/Prof Purchases - COGS 4015 Commissions Paid - COGS 4020 Merchant Account Fees Total 4000 Cost of Goods Sold" 18.000

Total Cost of Goods Sold

Gross Profit £ -30000

"Expenses 4500 Payroll Expenses"

"4505 Payroll Fees 4510 Payroll Taxes 4515 Payroll Wages 4520 Benefits Total 4500 Payroll Expenses" 23001%

15001%

38002%

5000 Sales & Marketing

"5005 Advertising and Promotion 5006 Education 5025 Meetings/Meals & Entertainment 5035 Recruiting 5045 Travel 5055 Website/Social Media Total 5000 Sales & Marketing Total 6030 Insurance 6050 Rent & Utilities"

£0000,00

25001%

6055 Rent 7500020%

"6060 Telephone/Internet 6066 Utilities Total 6050 Rent & Utilities 6070 Repair & Maintenance" 6500018%

4000,5%

67.900

£15,000

6085 Supplies

"6088 Office Supplies 6089 Cleaning Supplies 6090 Misc Supplies Total 6085 Supplies Total 6000 Operating Expenses"

110;0009%

6500 Management fees

"6505 Accounting Fees 6515 Legal Fees"

6525Business Licenses & Permits 2001%

"Total 6500 Management Fees Interest Expense Taxes" £20002%

2000020%

Total Expenses £165,0089

BOTTOM LINE/LOSS NET £230,0000

Answers: 3

Another question on Business

Business, 21.06.2019 21:00

Arriving and delivering a load of company executives for a business meeting at a destination far from home base requiring an overnight stay, a company’s pilot requested approval from the company finance office to pay to either have the company’s jet brought into the fbo's hangar overnight to protect it from a forecast snowfall or to have it de-iced by the fbo the following morning well-before scheduled departure. the company was under considerable financial pressure at the time, and the pilot’s requests were denied because of the cost. so, early the following morning, the pilot was up on the wing of the jet sweeping off an accumulation of snow and ice with a borrowed push broom in preparation for the scheduled departure with the executives, but slipped and fell to the ground, suffering a broken neck. the business was organized as a limited partnership, owned by 3 limited partners and one general partner. as a cost-saving measure, the company had dropped its workers’ compensation insurance before the accident. analyze the potential liability for the pilot’s injuries of each of the following, showing your reasoning clearly: the company the general partner the limited partners analyze how the outcome would have been different, if the business had been organized as a corporation and observed all of the formalities to legitimize its corporate status. analyze how the outcome would have been different, if the pilot had been covered by workers’ compensation insurance.

Answers: 3

Business, 21.06.2019 23:00

What is overdraft protection (odp)? a.) a cheap and easy way to always avoid overdrawing a bank account b.) a service to automatically transfer available funds from a linked account to cover purchases, prevent returned checks and declined items when you don’t have enough money in your checking account at the time of the transaction. c.) an insurance policy sold by banks to prevent others from withdrawing your money d.) a service provided by the government that insures individuals bank deposits up to $250,000

Answers: 2

Business, 22.06.2019 15:10

On december 31, 2013, coronado company issues 173,000 stock-appreciation rights to its officers entitling them to receive cash for the difference between the market price of its stock and a pre-established price of $10. the fair value of the sars is estimated to be $5 per sar on december 31, 2014; $2 on december 31, 2015; $10 on december 31, 2016; and $8 on december 31, 2017. the service period is 4 years, and the exercise period is 7 years. prepare a schedule that shows the amount of compensation expense allocable to each year affected by the stock-appreciation rights plan.

Answers: 2

Business, 22.06.2019 20:20

Reynolds corp. factors $400,000 of accounts receivable with mateer finance corporation on a without recourse basis on july 1, 2015. the receivables records are transferred to mateer finance, which will receive the collections. mateer finance assesses a finance charge of 1 ½ percent of the amount of accounts receivable and retains an amount equal to 4% of accounts receivable to cover sales discounts, returns, and allowances. the transaction is to be recorded as a sale.required: a. prepare the journal entry on july 1, 2015, for reynolds corp. to record the sale of receivables without recourse.b. prepare the journal entry on july 1, 2015, for mateer finance corporation to record the purchase of receivables without recourse— think through this.c. explain the difference between sale of receivables with recourse as oppose to without recourse.

Answers: 2

You know the right answer?

Questions

Mathematics, 04.05.2021 18:10

English, 04.05.2021 18:10

Geography, 04.05.2021 18:10

Mathematics, 04.05.2021 18:10

Mathematics, 04.05.2021 18:10

Mathematics, 04.05.2021 18:10

Chemistry, 04.05.2021 18:10

Mathematics, 04.05.2021 18:10

Biology, 04.05.2021 18:10

Mathematics, 04.05.2021 18:10