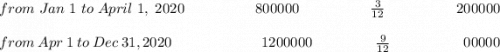

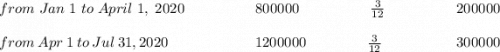

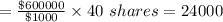

On June 1, 2018, Cheyenne Company and Ayayai Company merged to form Pina Inc. A total of 808,000 shares were issued to complete the merger. The new corporation reports on a calendar-year basis. On April 1, 2020, the company issued an additional 568,000 shares of stock for cash. All 1,376,000 shares were outstanding on December 31, 2020. Pina Inc. also issued $600,000 of 20-year, 7% convertible bonds at par on July 1, 2020. Each $1,000 bond converts to 44 shares of common at any interest date. None of the bonds have been converted to date. Pina Inc. is preparing its annual report for the fiscal year ending December 31, 2020. The annual report will show earnings per share figures based upon a reported after-tax net income of $1,547,000. (The tax rate is 20%.)

Determine the following for 2020.

(a) The number of shares to be used for calculating: (Round answers to 0 decimal places, e. g. $2,500.)

(1) Basic earnings per share enter a number of shares rounded to 0 decimal places shares

(2) Diluted earnings per share enter a number of shares rounded to 0 decimal places shares

(b) The earnings figures to be used for calculating: (Round answers to 0 decimal places, e. g. $2,500.)

(1) Basic earnings per share $enter a dollar amount rounded to 0 decimal places

(2) Diluted earnings per share $enter a dollar amount rounded to 0 decimal places

Answers: 1

Another question on Business

Business, 22.06.2019 01:30

Standardization is associated with which of the following management orientations? a) ethnocentric orientation b) polycentric orientation c) regiocentric orientation d) geocentric orientation

Answers: 1

Business, 22.06.2019 05:30

Suppose jamal purchases a pair of running shoes online for $60. if his state has a sales tax on clothing of 6 percent, how much is he required to pay in state sales tax?

Answers: 3

Business, 22.06.2019 06:50

On january 1, vermont corporation had 40,000 shares of $10 par value common stock issued and outstanding. all 40,000 shares has been issued in a prior period at $20.00 per share. on february 1, vermont purchased 3,750 shares of treasury stock for $24 per share and later sold the treasury shares for $21 per share on march 1. the journal entry to record the purchase of the treasury shares on february 1 would include a credit to treasury stock for $90,000 debit to treasury stock for $90,000 credit to a gain account for $112,500 debit to a loss account for $112,500

Answers: 3

Business, 22.06.2019 22:00

In 2018, laureen is currently single. she paid $2,800 of qualified tuition and related expenses for each of her twin daughters sheri and meri to attend state university as freshmen ($2,800 each for a total of $5,600). sheri and meri qualify as laureen’s dependents. laureen also paid $1,900 for her son ryan’s (also laureen’s dependent) tuition and related expenses to attend his junior year at state university. finally, laureen paid $1,200 for herself to attend seminars at a community college to her improve her job skills.what is the maximum amount of education credits laureen can claim for these expenditures in each of the following alternative scenarios? a. laureen's agi is $45,000.b. laureen’s agi is $95,000.c. laureen’s agi is $45,000 and laureen paid $12,000 (not $1,900) for ryan to attend graduate school (i.e, his fifth year, not his junior year).

Answers: 2

You know the right answer?

On June 1, 2018, Cheyenne Company and Ayayai Company merged to form Pina Inc. A total of 808,000 sha...

Questions

Chemistry, 14.01.2020 17:31

Geography, 14.01.2020 17:31

English, 14.01.2020 17:31

Social Studies, 14.01.2020 17:31

Business, 14.01.2020 17:31