Business, 05.06.2020 18:02 dantedelafuente

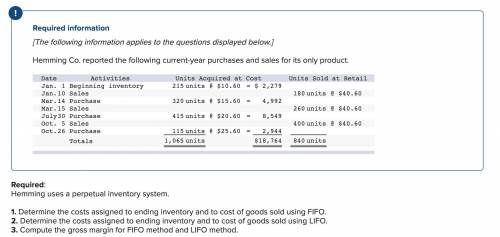

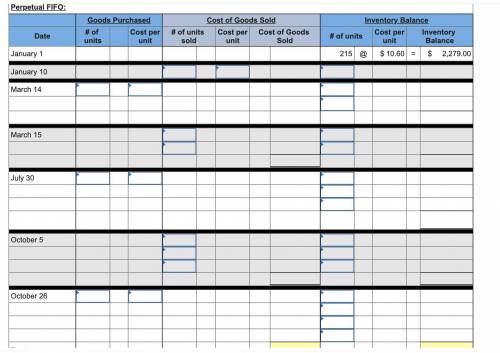

1. Determine the costs assigned to ending inventory and to cost of goods sold using FIFO.

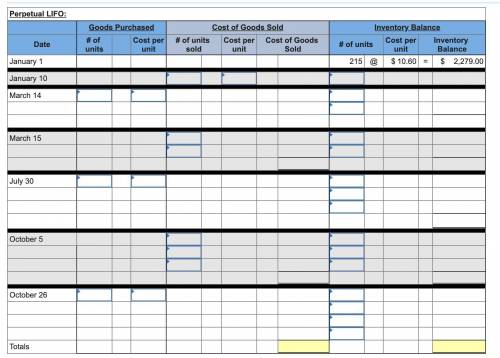

2. Determine the costs assigned to ending inventory and to cost of goods sold using LIFO.

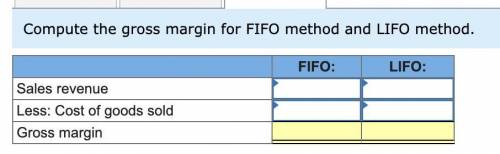

3. Compute the gross margin for FIFO method and LIFO method

Answers: 2

Another question on Business

Business, 22.06.2019 12:00

Suppose there are three types of consumers who attend concerts at your university’s performing arts center: students, staff, and faculty. each of these groups has a different willingness to pay for tickets; within each group, willingness to pay is identical. there is a fixed cost of $1,000 to put on a concert, but there are essentially no variable costs. for each concert: i. there are 140 students willing to pay $20. (ii) there are 200 staff members willing to pay $35. (iii) there are 100 faculty members willing to pay $50. a) if the performing arts center can charge only one price, what price should it charge? what are profits at this price? b) if the performing arts center can price discriminate and charge two prices, one for students and another for faculty/staff, what are its profits? c) if the performing arts center can perfectly price discriminate and charge students, staff, and faculty three separate prices, what are its profits?

Answers: 1

Business, 22.06.2019 19:40

Moody corporation uses a job-order costing system with a plantwide predetermined overhead rate based on machine-hours. at the beginning of the year, the company made the following estimates: machine-hours required to support estimated production 100,000 fixed manufacturing overhead cost $ 650,000 variable manufacturing overhead cost per machine-hour $ 3.00 required: 1. compute the plantwide predetermined overhead rate. 2. during the year, job 400 was started and completed. the following information was available with respect to this job: direct materials $ 450 direct labor cost $ 210 machine-hours used 40

Answers: 3

Business, 22.06.2019 20:10

While cell phones with holographic keyboards are currently in the introduction stage of the industry life cycle, tablet computers are in the growth stage. in the context of this scenario, which of the following statements is true? a. the industry for cell phones with holographic keyboards will face greater competition than the tablet industry. b. while the industry for cell phones with holographic keyboards will focus more on product innovation, the tablet industry will focus more on process innovation. c. while the industry for cell phones with holographic keyboards can reap the benefits of economies of scale, the tablet industry will experience no such benefits. d. the industry for cell phones with holographic keyboards will face price competition, whereas, in the tablet industry, the mode of competition will be non-price.

Answers: 2

You know the right answer?

1. Determine the costs assigned to ending inventory and to cost of goods sold using FIFO.

2. Determ...

Questions

Mathematics, 23.04.2020 16:54

History, 23.04.2020 16:54

Mathematics, 23.04.2020 16:54

Mathematics, 23.04.2020 16:54

Mathematics, 23.04.2020 16:55

English, 23.04.2020 16:55

Mathematics, 23.04.2020 16:55

Biology, 23.04.2020 16:55