Business, 05.05.2020 10:50 loulou6166

On January 1, 2021, the general ledger of ACME Fireworks includes the following account balances:

Accounts Debit Credit

Cash $ 25,600

Accounts Receivable 47,200

Allowance for

Uncollectible Accounts $ 4,700

Inventory 20,500

Land 51,000

Equipment 17,500

Accumulated Depreciation 2,000

Accounts Payable 29,000

Notes Payable

(6%, due April 1, 2022) 55,000

Common Stock 40,000

Retained Earnings 31,100

Totals $ 161,800 $ 161,800

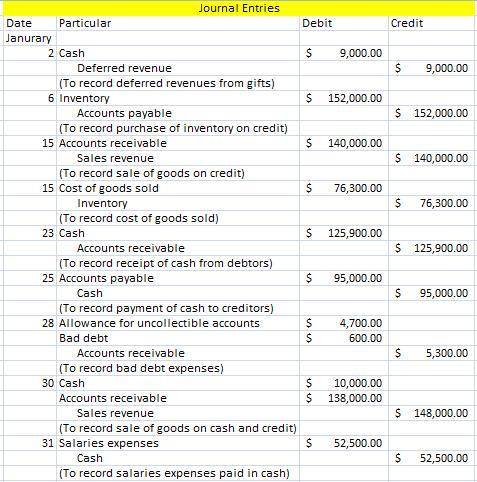

During January 2021, the following transactions occur:

January 2 Sold gift cards totaling $9,000. The cards are redeemable for merchandise within one year of the purchase date.

January 6 Purchase additional inventory on account, $152,000.

January 15 Firework sales for the first half of the month total $140,000. All of these sales are on account. The cost of the units sold is $76,300.

January 23 Receive $125,900 from customers on accounts receivable.

January 25 Pay $95,000 to inventory suppliers on accounts payable.

January 28 Write off accounts receivable as uncollectible, $5,300.

January 30 Firework sales for the second half of the month total $148,000. Sales include $10,000 for cash and $138,000 on account. The cost of the units sold is $82,000.

January 31 Pay cash for monthly salaries, $52,500.

1. Record each of the transactions listed above. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.)

Answers: 2

Another question on Business

Business, 21.06.2019 21:00

Which of the following is a reason why it is important for students to study strategy and the strategic management process? answers: studying strategy and the strategic management process can give students tools to evaluate the strategies of firms that may employ them.it can be very important to a new hire's career success to understand the strategies of the firm that hired them and their place in implementing these strategies.while strategic choices are generally limited to very experienced senior managers in large organizations, in smaller and entrepreneurial firms many employees end up being involved in the strategic management process.all of these.

Answers: 3

Business, 22.06.2019 11:40

Jamie is saving for a trip to europe. she has an existing savings account that earns 3 percent annual interest and has a current balance of $4,200. jamie doesn’t want to use her current savings for vacation, so she decides to borrow the $1,600 she needs for travel expenses. she will repay the loan in exactly one year. the annual interest rate is 6 percent. a. if jamie were to withdraw the $1,600 from her savings account to finance the trip, how much interest would she forgo? .b. if jamie borrows the $1,600 how much will she pay in interest? c. how much does the trip cost her if she borrows rather than dip into her savings?

Answers: 1

Business, 22.06.2019 19:30

Each row in a database is a set of unique information called a(n) table. record. object. field.

Answers: 3

Business, 22.06.2019 20:50

Power plants that rely on coal increase the amount of sulfur dioxide that dissolves into the air, eventually increasing the acidity of precipitation. the higher acidity of rain and snow can damage forests by making it more difficult for plants to absorb minerals from the soil. the equations below provide information about the market demand and supply of electricity. there is a constant marginal external cost of $25 per unit of electricity.d: qd= 200 – 2ps: qs=p – 10what quantity of electricity satisfies allocative efficiency in this market? a. 60b. 70c. 50d. 43.3

Answers: 2

You know the right answer?

On January 1, 2021, the general ledger of ACME Fireworks includes the following account balances:

Questions

Mathematics, 14.09.2021 14:00

Medicine, 14.09.2021 14:00

Social Studies, 14.09.2021 14:00

Mathematics, 14.09.2021 14:00

Computers and Technology, 14.09.2021 14:00

Mathematics, 14.09.2021 14:00

Mathematics, 14.09.2021 14:00

Spanish, 14.09.2021 14:00