Business, 05.05.2020 16:12 dsaefong00

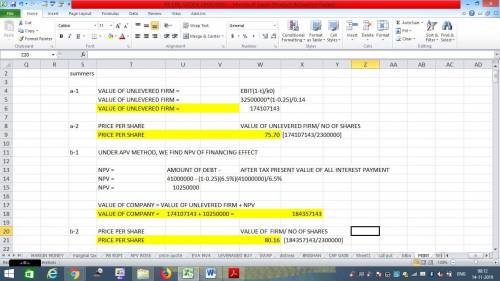

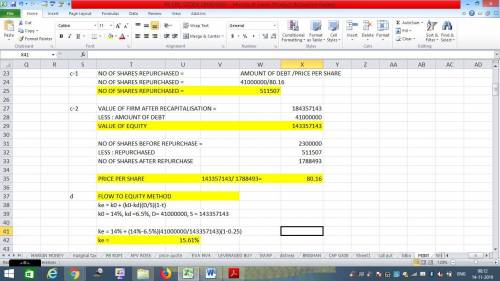

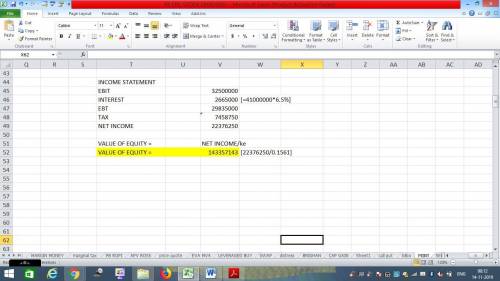

Summers, Inc., is an unlevered firm with expected annual earnings before taxes of $32.5 million in perpetuity. The current required return on the firm's equity is 14 percent and the firm distributes all of its earnings as dividends at the end of each year. The company has 2.3 million shares of common stock outstanding and is subject to a corporate tax rate of 25 percent. The firm is planning a recapitalization under which it will issue $41 million of perpetual 6.5 percent debt and use the proceeds to buy back shares. 6-1. Calculate the value of the company before the recapitalization plan is announced (Do not round Intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest whole number. e. a.. 1.234.567.) a-2. What is the price per share? (Do not round Intermediate c your answer to 2 decimal places, e. g., 32.16.) b-1. Use the APV method to calculate the company value after the recapitalization plan is announced. (Do not round Intermediate calculations and enter your answer In dollars, not millions of dollars, rounded to the nearest whole number, e. g., 1,234,567.) b-2. What is the price per share after the recapitalization is announced? (Do not round Intermediate calculations and round your answer to 2 decimal places, e. g., 32.16.) C-1. How many shares will be repurchased? (Do not round Intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the whole number, e. g., 1,234,567.) c-2. What is the price per share after the recapitalization and repurchase? (Do not round Intermediate calculations and round your answer to 2 decimal places, e. g., 32.16.) d. Use the flow to equity method to calculate the value of the company's equity after the recapitalization. (Do not round Intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest whole number, e. g., 1,234,567.)

Answers: 3

Another question on Business

Business, 22.06.2019 14:30

Stella company sells only two products, product a and product b. product a product b total selling price $50 $30 variable cost per unit $20 $10 total fixed costs $2,110,000 stella sells two units of product a for each unit it sells of product b. stella faces a tax rate of 40%. stella desires a net afterminustax income of $54,000. the breakeven point in units would be

Answers: 3

Business, 22.06.2019 19:00

Which of the following is likely not a benefit of requiring a grand jury to listen to and examine all of the evidence against a person suspected of committing a serious crime and then independently deciding whether or not to hand down an indictment? 1.the grand jury system provides the accused another safeguard against being sent to trial and facing conviction based on flawed evidence. 2.the members of the grand jury are drawn from the community and are empowered to render independent decisions about whether or not the government has collected enough evidence to bring an individual to trial. 3.the grand jury’s decision can provide prosecutors insight into what is necessary to build a sufficient case if a similar crime is presented later. 4.the grand jury is impaneled to rubber-stamp prosecutors’ cases, which makes it possible for more cases to reach trial.

Answers: 2

Business, 22.06.2019 19:10

After the price floor is instituted, the chairman of productions office buys up any barrels of gosum berries that the producers are not able to sell. with the price floor, the producers sell 300 barrels per month to consumers, but the producers, at this high price floor, produce 700 barrels per month. how much producer surplus is created with the price floor? show your calculations.

Answers: 2

Business, 22.06.2019 21:00

Haley photocopying purchases a paper from an out-of-state vendor. average weekly demand for paper is 150 cartons per week for which haley pays $15 per carton. in bound shipments from the vendor average 1000 cartoons with an average lead time of 3 weeks. haley operates 52 weeks per year; it carries a 4-week supply of inventory as safety stock and no anticipation inventory. the vendor has recently announced that they will be building a faculty near haley photocopying that will reduce lead time to one week. further, they will be able to reduce shipments to 200 cartons. haley believes that they will be able to reduce safety stock to a 1-week supply. what impact will these changes make to haley’s average inventory level and its average aggregated inventory value?

Answers: 1

You know the right answer?

Summers, Inc., is an unlevered firm with expected annual earnings before taxes of $32.5 million in p...

Questions

French, 01.04.2021 07:20

Advanced Placement (AP), 01.04.2021 07:20

History, 01.04.2021 07:20

Mathematics, 01.04.2021 07:20

Mathematics, 01.04.2021 07:20

History, 01.04.2021 07:20

Physics, 01.04.2021 07:20

Biology, 01.04.2021 07:20

Computers and Technology, 01.04.2021 07:20

English, 01.04.2021 07:20

Mathematics, 01.04.2021 07:20

Chemistry, 01.04.2021 07:20

History, 01.04.2021 07:20

Spanish, 01.04.2021 07:20