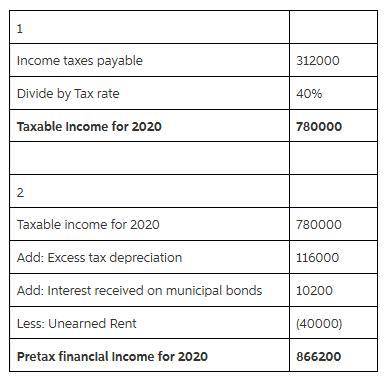

The following information is available for Teal Corporation for 2020. 1. Depreciation reported on the tax return exceeded depreciation reported on the income statement by $116,000. This difference will reverse in equal amounts of $29,000 over the years 2021–2024. 2. Interest received on municipal bonds was $9,700. 3. Rent collected in advance on January 1, 2020, totaled $55,800 for a 3-year period. Of this amount, $37,200 was reported as unearned at December 31, 2020, for book purposes. 4. The tax rates are 40% for 2020 and 35% for 2021 and subsequent years. 5. Income taxes of $350,000 are due per the tax return for 2020. 6. No deferred taxes existed at the beginning of 2020. Prepare the journal entries to record income tax expense, deferred income taxes, and income taxes payable for 2020 and 2021.

Answers: 2

Another question on Business

Business, 22.06.2019 02:30

Acompany using the perpetual inventory system purchased inventory worth $540,000 on account with credit terms of 2/15, n/45. defective inventory of $40,000 was returned 2 days later, and the accounts were appropriately adjusted. if the company paid the invoice 20 days later, the journal entry to record the payment would be

Answers: 1

Business, 22.06.2019 09:40

You plan to invest some money in a bank account. which of the following banks provides you with the highest effective rate of interest? hint: perhaps this problem requires some calculations. bank 1; 6.1% with annual compounding. bank 2; 6.0% with monthly compounding. bank 3; 6.0% with annual compounding. bank 4; 6.0% with quarterly compounding. bank 5; 6.0% with daily (365-day) compounding.

Answers: 3

Business, 22.06.2019 11:40

Jamie is saving for a trip to europe. she has an existing savings account that earns 3 percent annual interest and has a current balance of $4,200. jamie doesn’t want to use her current savings for vacation, so she decides to borrow the $1,600 she needs for travel expenses. she will repay the loan in exactly one year. the annual interest rate is 6 percent. a. if jamie were to withdraw the $1,600 from her savings account to finance the trip, how much interest would she forgo? .b. if jamie borrows the $1,600 how much will she pay in interest? c. how much does the trip cost her if she borrows rather than dip into her savings?

Answers: 1

Business, 22.06.2019 11:50

After graduation, you plan to work for dynamo corporation for 12 years and then start your own business. you expect to save and deposit $7,500 a year for the first 6 years (t = 1 through t = 6) and $15,000 annually for the following 6 years (t = 7 through t = 12). the first deposit will be made a year from today. in addition, your grandfather just gave you a $32,500 graduation gift which you will deposit immediately (t = 0). if the account earns 9% compounded annually, how much will you have when you start your business 12 years from now?

Answers: 1

You know the right answer?

The following information is available for Teal Corporation for 2020. 1. Depreciation reported on th...

Questions

Physics, 16.12.2020 22:30

Mathematics, 16.12.2020 22:30

Health, 16.12.2020 22:30

Mathematics, 16.12.2020 22:30

Arts, 16.12.2020 22:30

Mathematics, 16.12.2020 22:30

History, 16.12.2020 22:30

English, 16.12.2020 22:30

History, 16.12.2020 22:30

Mathematics, 16.12.2020 22:30

Advanced Placement (AP), 16.12.2020 22:30

Mathematics, 16.12.2020 22:30

History, 16.12.2020 22:30

Mathematics, 16.12.2020 22:30