Business, 20.04.2020 21:22 Beast3dgar

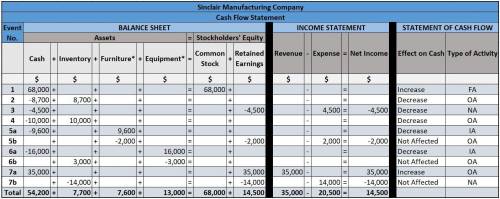

Sinclair Manufacturing Company experienced the following accounting events during its first year of operation. With the exception of the adjusting entries for depreciation, assume that all transactions are cash transactions and that financial statement data are prepared in accordance with GAAP

1. Acquired $68,000 cash by issuing common stock

2. Paid $8,700 for the materials used to make its products, all of which were started and completed during the year.

3. Paid salaries of $4,500 to selling and administrative employees

4. Paid wages of $10,000 to production workers

5. Paid $9,600 for furniture used in selling and administrative offices. The furniture was acquired on January 1. It had a $1,600 estimated salvage value and a four-year useful life 6. Paid $16,000 for manufacturing equipment. The equipment was acquired on January 1. It had a $1,000 estimated salvage value and a five-year useful life 7. Sold inventory to customers for $35,000 that had cost $14,000 to make Required Indicate how these events would affect the balance sheet and income statement by recording them in a horizontal financial statements model as indicated here. The first event is recorded as an example. (Enter any decreases to account balances with a minus sign. In the Cash Flow column, indicate whether the item is an operating activity (OA), investing activity (IA), financing activity (FA), or NA for not affected.

Answers: 2

Another question on Business

Business, 22.06.2019 17:10

Storico co. just paid a dividend of $3.15 per share. the company will increase its dividend by 20 percent next year and then reduce its dividend growth rate by 5 percentage points per year until it reaches the industry average of 5 percent dividend growth, after which the company will keep a constant growth rate forever. if the required return on the company’s stock is 12 percent, what will a share of stock sell for today?

Answers: 1

Business, 22.06.2019 20:00

Beranek corp has $720,000 of assets, and it uses no debt--it is financed only with common equity. the new cfo wants to employ enough debt to raise the debt/assets ratio to 40%, using the proceeds from borrowing to buy back common stock at its book value. how much must the firm borrow to achieve the target debt ratio? a. $273,600b. $288,000c. $302,400d. $317,520e. $333,396

Answers: 3

Business, 23.06.2019 09:30

You are a professor of economics at a university.? you've been offered the position of serving as department? head, which comes with an annual salary that is ? $5 comma 500 higher than your current salary.? however, the position will require you to work 200 additional hours per year. suppose the next best use of your time is spending it with your? family, which has value of ? $10 per hour.

Answers: 2

You know the right answer?

Sinclair Manufacturing Company experienced the following accounting events during its first year of...

Questions

Mathematics, 11.05.2021 14:40

Mathematics, 11.05.2021 14:40

Advanced Placement (AP), 11.05.2021 14:40

History, 11.05.2021 14:40

Mathematics, 11.05.2021 14:40

Health, 11.05.2021 14:40

English, 11.05.2021 14:40

Mathematics, 11.05.2021 14:40

Biology, 11.05.2021 14:40

Computers and Technology, 11.05.2021 14:40

Mathematics, 11.05.2021 14:40

Social Studies, 11.05.2021 14:40

History, 11.05.2021 14:40

Physics, 11.05.2021 14:50

Geography, 11.05.2021 14:50

Mathematics, 11.05.2021 14:50