Business, 27.03.2020 16:21 cathydaves

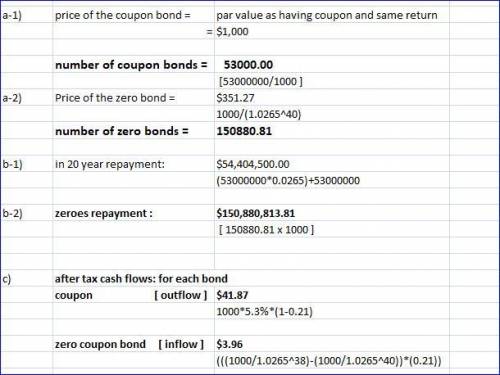

Suppose your company needs to raise $53 million and you want to issue 20-year bonds for this purpose. Assume the required return on your bond issue will be 5.3 percent, and you’re evaluating two issue alternatives: a semiannual coupon bond with a coupon rate of 5.3 percent, and a zero coupon bond. Your company’s tax rate is 21 percent. Both bonds will have a par value of $1,000. a-1. How many of the coupon bonds would you need to issue to raise the $53 million? a-2. How many of the zeroes would you need to issue? (Do not round intermediate calculations and round your answer to 2 decimal places, e. g., 32.16.) b-1. In 20 years, what will your company’s repayment be if you issue the coupon bonds? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, e. g., 1,234,567.) b-2. What if you issue the zeroes? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, e. g., 1,234,567.) c. Calculate the aftertax cash flows for the first year for each bond. (Do not round intermediate calculations and enter your answers in dollars, not millions of dollars, e. g., 1,234,567. Enter your answers as positive numbers.)

Answers: 3

Another question on Business

Business, 22.06.2019 00:00

Which statement is true of both presidential and parliamentary systems of government? a. the executive branch operates independently from the legislative branch. b. the members of the legislative branch are directly elected by the people. c. the head of government is chosen by members of his or her political party. d. the head of government is directly elected by the people

Answers: 1

Business, 22.06.2019 06:10

P11.2a (lo 2, 4) fechter corporation had the following stockholders’ equity accounts on january 1, 2020: common stock ($5 par) $500,000, paid-in capital in excess of par—common stock $200,000, and retained earnings $100,000. in 2020, the company had the following treasury stock transactions. journalize and post treasury stock transactions, and prepare stockholders’ equity section. mar. 1 purchased 5,000 shares at $8 per share. june 1 sold 1,000 shares at $12 per share. sept. 1 sold 2,000 shares at $10 per share. dec. 1 sold 1,000 shares at $7 per share. fechter corporation uses the cost method of accounting for treasury stock. in 2020, the company reported net income of $30,000. instructions a. journalize the treasury stock transactions, and prepare the closing entry at december 31, 2020, for net income. b. open accounts for (1) paid-in capital from treasury stock, (2) treasury stock, and (3) retained earnings. (post to t-accounts.) c. prepare the stockholders’ equity section for fechter corporation at december 31, 2020.

Answers: 1

Business, 22.06.2019 10:00

In a small group, members have taken on the task roles of information giver, critic/analyzer, and recorder, and the maintenance roles of gatekeeper and follower. they need to fulfill one more role. which of the following would be most effective for their group dynamics? a dominator b coordinator c opinion seeker d harmonizer

Answers: 1

Business, 22.06.2019 14:20

In canada, the reference base period for the cpi is 2002. by 2012, prices had risen by 21.6 percent since the base period. the inflation rate in canada in 2013 was 1.1 percent. calculate the cpi in canada in 2013. hint: use the information that “prices had risen by 21.6 percent since the base period” to find the cpi in 2012. use the inflation rate formula (inflation is the growth rate of the cpi) to find cpi in 2013, knowing the cpi in 2012 and the inflation rate. the cpi in canada in 2013 is round up your answer to the first decimal. 122.9 130.7 119.6 110.5

Answers: 1

You know the right answer?

Suppose your company needs to raise $53 million and you want to issue 20-year bonds for this purpose...

Questions

Mathematics, 20.10.2019 09:20

Mathematics, 20.10.2019 09:20

Social Studies, 20.10.2019 09:20

Computers and Technology, 20.10.2019 09:20

Health, 20.10.2019 09:20

Mathematics, 20.10.2019 09:20

Biology, 20.10.2019 09:20

English, 20.10.2019 09:20

History, 20.10.2019 09:20

English, 20.10.2019 09:20

Mathematics, 20.10.2019 09:20