Business, 20.03.2020 06:58 ezzyandrade7

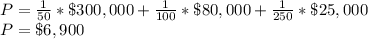

G Suppose that a person faces a 1/50 chance of her house burning down, which is worth $300,000, a 1/100 chance of requiring a surgery that costs $80,000, and a 1/250 chance of getting involved in an auto accident that destroys her car which is worth $25,000. What is an actuarially fair price for an insurance policy that insures against all those risks

Answers: 1

Another question on Business

Business, 22.06.2019 07:30

Which of the following is an example of an unsought good? a. cameron purchases a new bike. b. jordan buys paper towels. c. taylor buys cupcakes from her favorite bakery. d. riley buys new windshield wipers for her car.

Answers: 3

Business, 22.06.2019 10:20

Asmartphone manufacturing company uses social media to achieve different business objectives. match each social media activity of the company to the objective it the company achieve.

Answers: 2

Business, 22.06.2019 17:30

Four students are at an extracurricular activity fair at their high school and are trying to decide which clubs to join. some information about the students is listed in this chart: which describes which ctso each student should join?

Answers: 1

Business, 22.06.2019 18:00

When peter metcalf describes black diamond’s manufacturing facility in china as a “greenfield project,” he means that partnered with a chinese company to buy the plant . of all market entry strategies, this one carries the lowest risk. because black diamond manufactures its outdoor sports products outside the united states, what risks must its managers be aware of?

Answers: 1

You know the right answer?

G Suppose that a person faces a 1/50 chance of her house burning down, which is worth $300,000, a 1/...

Questions

Biology, 28.09.2020 14:01

Mathematics, 28.09.2020 14:01

Chemistry, 28.09.2020 14:01

Mathematics, 28.09.2020 14:01

Mathematics, 28.09.2020 14:01

Mathematics, 28.09.2020 14:01

Chemistry, 28.09.2020 14:01

Mathematics, 28.09.2020 14:01

Computers and Technology, 28.09.2020 14:01

Mathematics, 28.09.2020 14:01

Mathematics, 28.09.2020 14:01

Mathematics, 28.09.2020 14:01