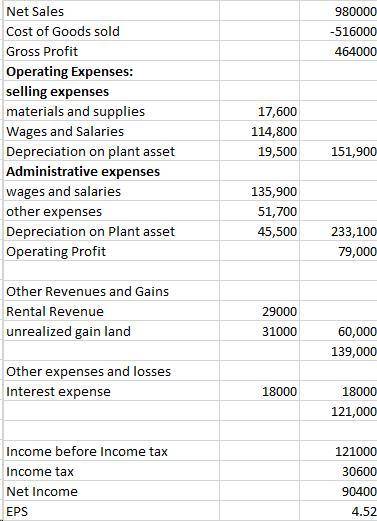

The accountant of Weatherspoon Shoe Co. has compiled the following information from the company's records as a basis for an income statement for the year ended December 31, 2010.

Rental revenue $29,000

Interest expense 18,000

Market appreciation on land above cost 31,000

Wages and salaries-sales 114,800

Materials and supplies-sales 17,600

Income tax 30,600

Wages and salaries-administrative 135,900

Other administrative expenses 51,700

Cost of goods sold 516,000

Net sales 980,000

Depreciation on plant assets (70% selling, 30% administrative) 65,000

Dividends declared 16,000

There were 20,000 shares of common stock outstanding during the year.

(a) Prepare a multiple-step income statement. (Round earnings per share to 2 decimal places, e. g. 5.25. For multiple entries list from largest to smallest amounts, e. g. 10, 5, 1. Enter all amounts as positive amounts and subtract where necessary.)

Answers: 1

Another question on Business

Business, 21.06.2019 14:20

David and darlene jasper have one child, sam, who is 6 years old (birthdate july 1, 2011). the jaspers reside at 4639 honeysuckle lane, los angeles, ca 90248. david's social security number is 577-11-3311, darlene's is 477-98-4731, and sam's is 589-22-1142. david's birthdate is may 29, 1984 and darlene's birthday is january 31, 1986. david and darlene's earnings and withholdings for 2017 are:

Answers: 2

Business, 22.06.2019 13:10

Thomas kratzer is the purchasing manager for the headquarters of a large insurance company chain with a central inventory operation. thomas's fastest-moving inventory item has a demand of 6,000 units per year. the cost of each unit is $100, and the inventory carrying cost is $10 per unit per year. the average ordering cost is $30 per order. it takes about 5 days for an order to arrive, and the demand for 1 week is 120 units. (this is a corporate operation, and the are 250 working days per year.)a) what is the eoq? b) what is the average inventory if the eoq is used? c) what is the optimal number of orders per year? d) what is the optimal number of days in between any two orders? e) what is the annual cost of ordering and holding inventory? f) what is the total annual inventory cost, including cost of the 6,000 units?

Answers: 3

Business, 22.06.2019 13:40

Jacob is a member of wcc (an llc taxed as a partnership). jacob was allocated $155,000 of business income from wcc for the year. jacob’s marginal income tax rate is 37 percent. the business allocation is subject to 2.9 percent of self-employment tax and 0.9 percent additional medicare tax. (round your intermediate calculations to the nearest whole dollar a) what is the amount of tax jacob will owe on the income allocation if the income is not qualified business income? b) what is the amount of tax jacob will owe on the income allocation if the income is qualified business income (qbi) and jacob qualifies for the full qbi duduction?

Answers: 2

You know the right answer?

The accountant of Weatherspoon Shoe Co. has compiled the following information from the company's re...

Questions

History, 05.02.2020 02:52

Mathematics, 05.02.2020 02:52

Geography, 05.02.2020 02:52

Mathematics, 05.02.2020 02:52

Mathematics, 05.02.2020 02:52

English, 05.02.2020 02:52

Physics, 05.02.2020 02:52

Mathematics, 05.02.2020 02:52

Mathematics, 05.02.2020 02:52

History, 05.02.2020 02:52

Mathematics, 05.02.2020 02:52

Spanish, 05.02.2020 02:52

Health, 05.02.2020 02:52