Business, 17.03.2020 04:38 loredobrooke5245

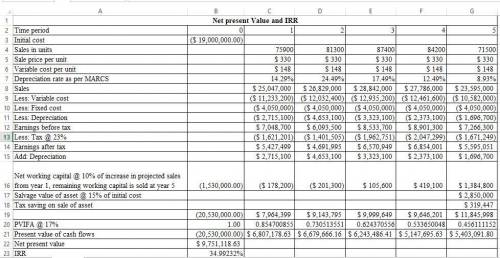

Aday Acoustics, Inc., projects unit sales for a new 7-octave voice emulation implant as follows: Year Unit Sales 1 75,900 2 81,300 3 87,400 4 84,200 5 71,500 Production of the implants will require $1,530,000 in net working capital to start and additional net working capital investments each year equal to 10 percent of the projected sales increase for the following year. Total fixed costs are $4,050,000 per year, variable production costs are $148 per unit, and the units are priced at $330 each. The equipment needed to begin production has an installed cost of $19,000,000. Because the implants are intended for professional singers, this equipment is considered industrial machinery and thus qualifies as 7-year MACRS property. In five years, this equipment can be sold for about 15 percent of its acquisition cost. The company is in the 23 percent marginal tax bracket and has a required return on all its projects of 17 percent. MACRS schedule. What is the NPV of the project?What is the IRR of the project?

Answers: 2

Another question on Business

Business, 21.06.2019 22:00

If a bond is issued at a premium the effective interest rate is most likely

Answers: 2

Business, 22.06.2019 06:30

Double corporation acquired all of the common stock of simple company for

Answers: 2

Business, 22.06.2019 09:50

For each of the following users of financial accounting information and managerial accounting information, specify whether the user would primarily use financial accounting information or managerial accounting information or both: 1. sec examiner 2. bookkeeping department 3. division controller 4. external auditor (public accounting firm) 5. loan officer at the company's bank 6. state tax agency auditor 7. board of directors 8. manager of the service department 9. wall street analyst 10. internal auditor 11. potential investors 12, current stockholders 13. reporter from the wall street journal 14. regional division managers

Answers: 1

Business, 22.06.2019 09:50

Is exploiting a distinctive competence or improving efficiency for competitive advantage. (a) cooptation (b) coalition (c) competitive intelligence (d) competitive aggression (e) smoothing

Answers: 1

You know the right answer?

Aday Acoustics, Inc., projects unit sales for a new 7-octave voice emulation implant as follows: Yea...

Questions

Computers and Technology, 28.11.2020 01:00

Mathematics, 28.11.2020 01:00

Social Studies, 28.11.2020 01:00

History, 28.11.2020 01:00

Mathematics, 28.11.2020 01:00

Chemistry, 28.11.2020 01:00