Business, 11.03.2020 03:04 juliannabartra

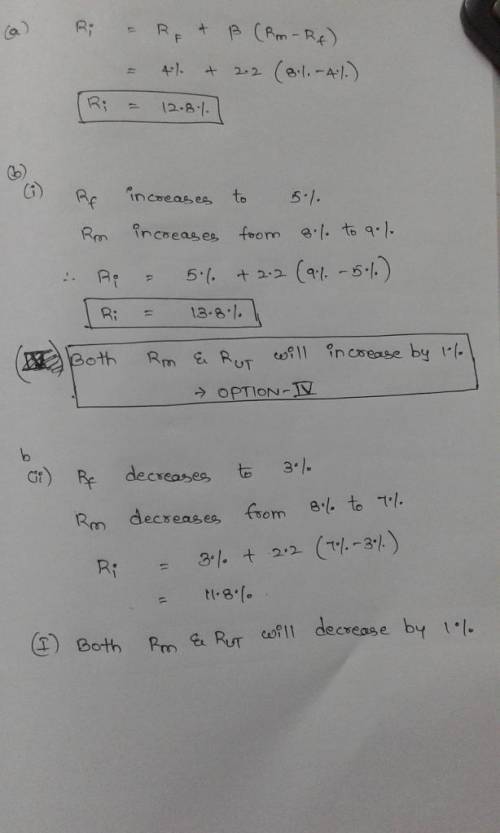

Required Rate of Return As an equity analyst you are concerned with what will happen to the required return to Universal Toddler' stock as market conditions change. Suppose rRF = 4%, rM = 8%, and bUT = 2.2. Under current conditions, what is rUT, the required rate of return on UT Stock?

Round your answer to two decimal places. 12.8 %

Now suppose rRF increases to 5%. The slope of the SML remains constant. How would this affect rM and rUT?

I. rM will increase by 1% and rUT will remain the same.

II. Both rM and rUT will decrease by 1%.

III. Both rM and rUT will remain the same.

IV. Both rM and rUT will increase by 1%.

V. rM will remain the same and rUT will increase by 1%.

Answers: 1

Another question on Business

Business, 22.06.2019 13:40

The cook corporation has two divisions--east and west. the divisions have the following revenues and expenses: east west sales $ 603,000 $ 506,000 variable costs 231,000 300,000 traceable fixed costs 151,500 192,000 allocated common corporate costs 128,600 156,000 net operating income (loss) $ 91,900 $ (142,000 ) the management of cook is considering the elimination of the west division. if the west division were eliminated, its traceable fixed costs could be avoided. total common corporate costs would be unaffected by this decision. given these data, the elimination of the west division would result in an overall company net operating income (loss)

Answers: 1

Business, 22.06.2019 19:00

15. chef a insists that roux is the traditional thickener for bisque. chef b insists that it's rice. which chef is correct? a. neither chef is correct. b. both chefs are correct. c. chef b is correct. d. chef a is correct.

Answers: 1

Business, 22.06.2019 19:30

He moto hotel opened for business on may 1, 2017. here is its trial balance before adjustment on may 31. moto hotel trial balance may 31, 2017 debit credit cash $ 2,283 supplies 2,600 prepaid insurance 1,800 land 14,783 buildings 72,400 equipment 16,800 accounts payable $ 4,483 unearned rent revenue 3,300 mortgage payable 38,400 common stock 59,783 rent revenue 9,000 salaries and wages expense 3,000 utilities expense 800 advertising expense 500 $114,966 $114,966 other data: 1. insurance expires at the rate of $360 per month. 2. a count of supplies shows $1,050 of unused supplies on may 31. 3. (a) annual depreciation is $2,760 on the building. (b) annual depreciation is $2,160 on equipment. 4. the mortgage interest rate is 5%. (the mortgage was taken out on may 1.) 5. unearned rent of $2,580 has been earned. 6. salaries of $810 are accrued and unpaid at may 31

Answers: 2

Business, 22.06.2019 23:00

If the reserve requirement is 10 percent, what amount of excess reserves does a bank acquire when a business deposits a $500 check drawn on another bank?

Answers: 2

You know the right answer?

Required Rate of Return As an equity analyst you are concerned with what will happen to the required...

Questions

Mathematics, 21.06.2020 23:57

Mathematics, 21.06.2020 23:57

Computers and Technology, 21.06.2020 23:57

Mathematics, 21.06.2020 23:57