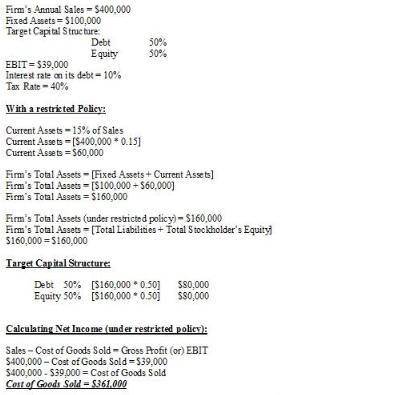

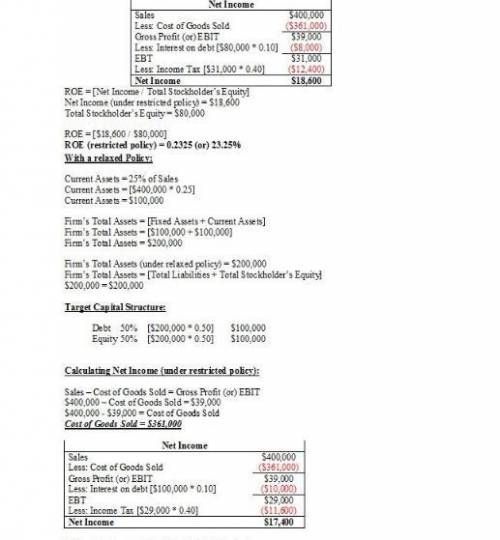

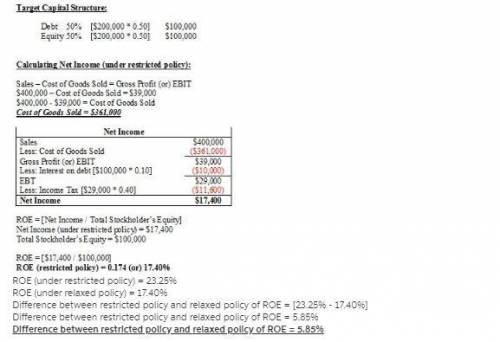

Edwards enterprises follows a moderate current asset investment policy, but it is now considering a change, perhaps to a restricted or maybe to a relaxed policy. the firm's annual sales are $400,000; its fixed assets are $100,000; its target capital structure calls for 50% debt and 50% equity; its ebit is $39,000; the interest rate on its debt is 10%; and its tax rate is 40%. with a restricted policy, current assets will be 15% of sales, while under a relaxed policy they will be 25% of sales. what is the difference in the projected roes between the restricted and relaxed policies?

Answers: 2

Another question on Business

Business, 22.06.2019 01:50

Which value describes the desire to be one’s own boss? a. autonomy b. status c. security d. entrepreneurship

Answers: 2

Business, 22.06.2019 02:50

Seattle bank’s start-up division establishes new branch banks. each branch opens with three tellers. total teller cost per branch is $96,000 per year. the three tellers combined can process up to 90,000 customer transactions per year. if a branch does not attain a volume of at least 60,000 transactions during its first year of operations, it is closed. if the demand for services exceeds 90,000 transactions, an additional teller is hired and the branch is transferred from the start-up division to regular operations. required what is the relevant range of activity for new branch banks

Answers: 2

Business, 22.06.2019 11:40

Manipulation manufacturing's (amm) standards anticipate that there will be 5 pounds of raw material used for every unit of finished goods produced. amm began the month of maymay with 8,000 pounds of raw material, purchased 25,500 pounds for $ 15,300 and ended the month with 7,400 pounds on hand. the company produced 4,9004,900 units of finished goods. the company estimates standard costs at $ 1.10 per pound. the materials price and efficiency variances for the month of maymay were:

Answers: 1

Business, 22.06.2019 20:20

Tl & co. is following a related-linked diversification strategy, and soar inc. is following a related-constrained diversification strategy. how do the two firms differ from each other? a. soar inc. generates 70 percent of its revenues from its primary business, while tl & co. generates only 10 percent of its revenues from its primary business. b. soar inc. pursues a backward diversification strategy, while tl & co. pursues a forward diversification strategy. c. tl & co. will share fewer common competencies and resources between its various businesses when compared to soar inc. d. tl & co. pursues a differentiation strategy, and soar inc. pursues a cost-leadership strategy, to gain a competitive advantage.

Answers: 3

You know the right answer?

Edwards enterprises follows a moderate current asset investment policy, but it is now considering a...

Questions

Mathematics, 16.02.2021 03:40

Business, 16.02.2021 03:40

Mathematics, 16.02.2021 03:40

English, 16.02.2021 03:40

Business, 16.02.2021 03:40

Mathematics, 16.02.2021 03:40

Spanish, 16.02.2021 03:40

Mathematics, 16.02.2021 03:40

Mathematics, 16.02.2021 03:40

Mathematics, 16.02.2021 03:40

English, 16.02.2021 03:40

Mathematics, 16.02.2021 03:40

Social Studies, 16.02.2021 03:40

Biology, 16.02.2021 03:40

Arts, 16.02.2021 03:40

Mathematics, 16.02.2021 03:40