Business, 04.12.2019 05:31 chitteshchandra56

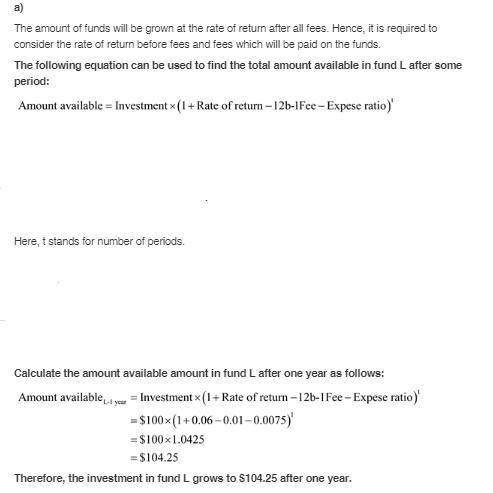

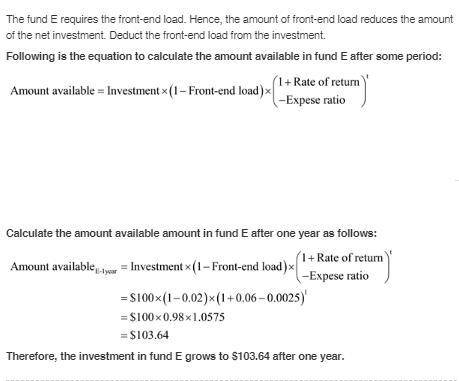

Loaded-up fund charges a 12b-1 fee of 1.0% and maintains an expense ratio of 0.75%. economy fund charges a front-end load of 2% but has no 12b-1 fee and an expense ratio of 0.25%. assume the rate of return on both funds’ portfolios (before any fees) is 6% per year. how much will an investment of $1,000 in each fund grow to after: (round your answers to 2 decimal places.)

Answers: 1

Another question on Business

Business, 21.06.2019 14:40

Easel manufacturing budgeted fixed overhead costs of $ 1.50 per unit at an anticipated production level of 1 comma 350 units. in july easel incurred actual fixed overhead costs of $ 4 comma 700 and actually produced 1 comma 300 units. what is easel's fixed overhead budget variance for july?

Answers: 2

Business, 22.06.2019 11:10

Suppose that the firm cherryblossom has an orchard they are willing to sell today. the net annual returns to the orchard are expected to be $50,000 per year for the next 20 years. at the end of 20 years, it is expected the land will sell for $30,000. calculate the market value of the orchard if the market rate of return on comparable investments is 16%.

Answers: 1

Business, 22.06.2019 12:00

Agovernment receives a gift of cash and investments with a fair value of $200,000. the donor specified that the earnings from the gift must be used to beautify city-owned parks and the principal must be re-invested. the $200,000 gift should be accounted for in which of the following funds? a) general fund b) private-purpose trust fund c) agency fund d) permanent fund

Answers: 1

Business, 22.06.2019 21:30

China white was the black market selling of ivory, in which the profit was redistributed back into the trafficking of heroin.

Answers: 3

You know the right answer?

Loaded-up fund charges a 12b-1 fee of 1.0% and maintains an expense ratio of 0.75%. economy fund cha...

Questions

Mathematics, 15.11.2019 01:31

Social Studies, 15.11.2019 01:31

English, 15.11.2019 01:31

Mathematics, 15.11.2019 01:31

Health, 15.11.2019 01:31

History, 15.11.2019 01:31

English, 15.11.2019 01:31

Mathematics, 15.11.2019 01:31

History, 15.11.2019 01:31

Mathematics, 15.11.2019 01:31

Mathematics, 15.11.2019 01:31