Business, 23.11.2019 02:31 alexalvarez304

For which capital component must you make a tax adjustment when calculating a firm’s weighted average cost of capital (wacc)?

a. debt

b. equity

c. preferred stock

omni consumer products company (ocp) can borrow funds at an interest rate of 12.50% for a period of seven years. its marginal federal-plus-state tax rate is 30%. ocp’s after-tax cost of debt is (rounded to two decimal places).

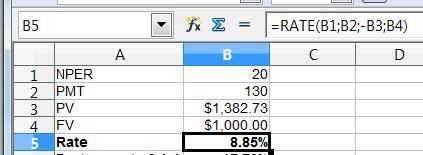

at the present time, omni consumer products company (ocp) has 20-year noncallable bonds with a face value of $1,000 that are outstanding. these bonds have a current market price of $1,382.73 per bond, carry a coupon rate of 13%, and distribute annual coupon payments. the company incurs a federal-plus-state tax rate of 30%. if ocp wants to issue new debt, what would be a reasonable estimate for its after-tax cost of debt (rounded to two decimal places)? (note: round your ytm rate to two decimal place.)

Answers: 2

Another question on Business

Business, 22.06.2019 17:00

Alpha company uses the periodic inventory system for purchase & sales of merchandise. discount terms for both purchases & sales are, 2/10, n30 and the gross method is used. unless otherwise noted, fob destination will apply to all purchases & sales. the value of inventory is based on periodic system. on january 1, 2016, beginning inventory consisted of 350 units of widgets costing $10 each. alpha prepares monthly income statements. the following events occurred during the month of jan.: dateactivitya.jan. 3purchased on account 350 widgets for $11 each.b.jan. 5sold on account 400 widgets for $30 each. paid freight out with petty cash of $150.c.jan. 10purchased on account 625 widgets for $12 each.d.jan. 11shipping cost for the january 10 purchased merchandise was $400 was paid with a cheque by alpha directly to the freight company.e.jan. 12returned 50 widgets received from jan. 10 purchase as they were not the correct item ordered.f.jan. 13paid for the purchases made on jan. 3.g.jan. 21sold on account 550 widgets for $30 each. paid freight out with petty cash of $250.h.jan. 22authorize credit without return of goods for 50 widgets sold on jan. 21 when customer advised that they were received in defective condition.i.jan. 25received payment for the sale made on jan. 5.j.jan. 26paid for the purchases made on jan. 10.k.jan. 31received payment for the sale made on jan. 21.use this information to prepare the general journal entries (without explanation) for the january events. if no entry is required then enter the date and write "no entry required."

Answers: 2

Business, 22.06.2019 20:00

Afirm is producing at minimum average total cost with its current plant. draw the firm's long-run average cost curve. label it. draw a point on the lrac curve at which the firm cannot lower its average total cost. draw the firm's short-run average total cost curve that is consistent with the point you have drawn. label it.g

Answers: 2

Business, 22.06.2019 20:50

Swathmore clothing corporation grants its customers 30 days' credit. the company uses the allowance method for its uncollectible accounts receivable. during the year, a monthly bad debt accrual is made by multiplying 3% times the amount of credit sales for the month. at the fiscal year-end of december 31, an aging of accounts receivable schedule is prepared and the allowance for uncollectible accounts is adjusted accordingly. at the end of 2012, accounts receivable were dollar 586.000 and the allowance account had a credit balance of dollar 50,000. accounts receivable activity for 2013 was as follows: the company's controller prepared the following aging summary of year-end accounts receivable: prepare a summary journal entry to record the monthly bad debt accrual and the write-offs during the year. (if no entry is required for a particular event, select "no journal entry required" in the first account field.) prepare the necessary year-end adjusting entry for bad debt expense. (if no entry is required for an event, select "no journal entry required" in the first account field.) what is total bad debt expense for 2013? calculate the amount of accounts receivable that would appear in the 2013 balance sheet?

Answers: 2

Business, 22.06.2019 21:10

Kinc. has provided the following data for the month of may: inventories: beginning ending work in process $ 17,000 $ 12,000 finished goods $ 46,000 $ 50,000 additional information: direct materials $ 57,000 direct labor cost $ 87,000 manufacturing overhead cost incurred $ 63,000 manufacturing overhead cost applied to work in process $ 61,000 any underapplied or overapplied manufacturing overhead is closed out to cost of goods sold. the adjusted cost of goods sold that appears on the income statement for may is:

Answers: 3

You know the right answer?

For which capital component must you make a tax adjustment when calculating a firm’s weighted averag...

Questions

Law, 26.11.2019 00:31

Mathematics, 26.11.2019 00:31

Mathematics, 26.11.2019 00:31