Business, 13.09.2019 02:20 lilpump3506

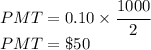

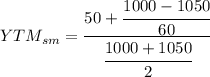

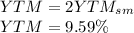

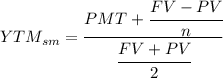

Bond yields and rates of return a 30-year, 10% semiannual coupon bond with a par value of $1,000 may be called in 4 years at a call price of $1,100. the bond sells for $1,050. (assume that the bond has just been issued.) what is the bond's yield to maturity? do not round intermediate calculations. round your answer to two decimal places.

Answers: 3

Another question on Business

Business, 22.06.2019 06:30

Selected data for stick’s design are given as of december 31, year 1 and year 2 (rounded to the nearest hundredth). year 2 year 1 net credit sales $25,000 $30,000 cost of goods sold 16,000 18,000 net income 2,000 2,800 cash 5,000 900 accounts receivable 3,000 2,000 inventory 2,000 3,600 current liabilities 6,000 5,000 compute the following: 1. current ratio for year 2 2. acid-test ratio for year 2 3. accounts receivable turnover for year 2 4. average collection period for year 2 5. inventory turnover for year 2

Answers: 2

Business, 22.06.2019 07:50

The questions of economics address which of the following ? check all that apply

Answers: 3

Business, 22.06.2019 17:30

What do you think: would it be more profitable to own 200 shares of penny’s pickles or 1 share of exxon? why do you think that?

Answers: 1

Business, 22.06.2019 21:00

In a transportation minimization problem, the negative improvement index associated with a cell indicates that reallocating units to that cell would lower costs.truefalse

Answers: 1

You know the right answer?

Bond yields and rates of return a 30-year, 10% semiannual coupon bond with a par value of $1,000 may...

Questions

Mathematics, 02.06.2021 07:00

Mathematics, 02.06.2021 07:00

Mathematics, 02.06.2021 07:00

Mathematics, 02.06.2021 07:00

Computers and Technology, 02.06.2021 07:00

Mathematics, 02.06.2021 07:00

Mathematics, 02.06.2021 07:00

Mathematics, 02.06.2021 07:00

History, 02.06.2021 07:00

History, 02.06.2021 07:00

History, 02.06.2021 07:00

Mathematics, 02.06.2021 07:00

Mathematics, 02.06.2021 07:00

Mathematics, 02.06.2021 07:10

periods.

periods.