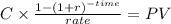

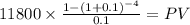

Park co. is considering an investment that requires immediate payment of $34,000 and provides expected cash inflows of $11,800 annually for four years. if park co. requires a 10% return on its investments. 1-a what is the net present value of this investment? (fv of $1, pv of $1, fva of $1 and pva of $1) (use appropriate factor(s) from the tables provided.)

Answers: 2

Another question on Business

Business, 21.06.2019 20:40

Balances for each of the following accounts appear in an adjusted trial balance. identify each as an asset, liability, revenue, or expense. 1. accounts receivable 2. equipment 3. fees earned 4. insurance expense 5. prepaid advertising 6. prepaid rent 7. rent revenue 8. salary expense 9. salary payable 10. supplies 11. supplies expense 12. unearned rent

Answers: 3

Business, 21.06.2019 21:30

Daniel owns 100 shares of abc corporation's common stock. abc uses the fair value option, and recent declines in the firm's credit rating have caused the value of the firm's outstanding bonds payable to drop by 10%. daniel feels this is good news, but he wants to know what you think about the situation. which of the following represents your best response? a : "this situation may be positive for you in that the change in abc's credit standing indicates that the value of the firm's assets is likely increasing. however, the drop in bond value may negate any positive effects on your bottom line, because it means your claim on the firm's assets is simultaneously decreasing." b : "actually, this is bad news all around. the drop in the value of abc's bonds payable means shareholders' claims on the firm's assets have decreased. moreover, abc's declining credit rating means that the firm's assets are probably also dropping in value, thus magnifying your losses even more." c : "on the surface, this seems like good news because it means your claim on the firm's assets has increased. however, the drop in creditworthiness may also indicate that abc's assets are declining in value, thus offsetting any gains associated with the drop in bonds payable." d : "you're right! this is good news because it means that abc's debtholders have a decreased claim on the firm's assets. as a result, the firm's existing shareholders"like you"have seen their claim on the firm's assets increase."

Answers: 2

Business, 22.06.2019 11:00

T-comm makes a variety of products. it is organized in two divisions, north and south. the managers for each division are paid, in part, based on the financial performance of their divisions. the south division normally sells to outside customers but, on occasion, also sells to the north division. when it does, corporate policy states that the price must be cost plus 20 percent to ensure a "fair" return to the selling division. south received an order from north for 300 units. south's planned output for the year had been 1,200 units before north's order. south's capacity is 1,500 units per year. the costs for producing those 1,200 units follow

Answers: 1

Business, 22.06.2019 11:20

Which stage of group development involves members introducing themselves to each other?

Answers: 3

You know the right answer?

Park co. is considering an investment that requires immediate payment of $34,000 and provides expect...

Questions

English, 18.07.2019 11:00

Mathematics, 18.07.2019 11:00

History, 18.07.2019 11:00

Mathematics, 18.07.2019 11:00

Health, 18.07.2019 11:00

History, 18.07.2019 11:00

History, 18.07.2019 11:00

Arts, 18.07.2019 11:00

English, 18.07.2019 11:00