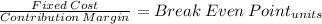

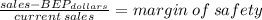

Mary willis is the advertising manager for bargain shoe store. she is currently working on a major promotional campaign. her ideas include the installation of a new lighting system and increased display space that will add $54,600 in fixed costs to the $399,000 currently spent. in addition, mary is proposing that a 5% price decrease ($60 to $57) will produce a 20% increase in sales volume (20,000 to 24,000). variable costs will remain at $36 per pair of shoes. management is impressed with mary’s ideas but concerned about the effects that these changes will have on the break-even point and the margin of safety. compute the current break-even point in units, and compare it to the break-even point in units if mary’s ideas are used. (round answers to 0 decimal places, e. g. 1,225.) current break-even point pairs of shoes new break-even point pairs of shoes

Answers: 1

Another question on Business

Business, 22.06.2019 09:40

As related to a company completing the purchase to pay process, is there an accounting journal entry "behind the scenes" when xyz company pays for the goods within 10 days of the invoice (gross method is used for discounts and terms are 2/10 net 30) that updates the general ledger?

Answers: 3

Business, 22.06.2019 11:30

Which of the following is not an example of one of the four mail advantages of prices on a free market economy

Answers: 1

Business, 22.06.2019 12:40

Acompany has $80,000 in outstanding accounts receivable and it uses the allowance method to account for uncollectible accounts. experience suggests that 6% of outstanding receivables are uncollectible. the current credit balance (before adjustments) in the allowance for doubtful accounts is $1,200. the journal entry to record the adjustment to the allowance account includes a debit to bad debts expense for $4,800. true or false

Answers: 3

Business, 22.06.2019 17:30

Google started as one of many internet search engines, amazon started as an online book seller, and ebay began as a site where people could sell used personal items in auctions. these firms have grown to be so large and dominant that they are facing antitrust scrutiny from competition regulators in the us and elsewhere. did these online giants grow by fairly beating competition, or did they use unfair advantages? are there any clouds on the horizon for these firms -- could they face diseconomies of scale or diseconomies of scope as they continue to grow? if so, what factors may limit their continued growth?

Answers: 1

You know the right answer?

Mary willis is the advertising manager for bargain shoe store. she is currently working on a major p...

Questions

Mathematics, 13.02.2022 17:40

Physics, 13.02.2022 17:40

Mathematics, 13.02.2022 17:40

Mathematics, 13.02.2022 17:40

Computers and Technology, 13.02.2022 17:40

Mathematics, 13.02.2022 17:40

Mathematics, 13.02.2022 17:40

Mathematics, 13.02.2022 17:40

Mathematics, 13.02.2022 17:40

Mathematics, 13.02.2022 17:50