Business, 22.07.2019 02:10 NotYourStudent

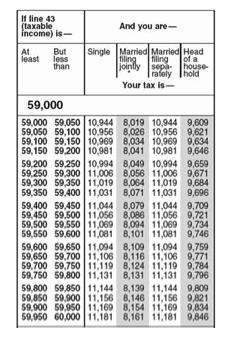

Christian's taxable income last year was $59,450. according to the tax table below, how much tax does he have to pay if he files with the "single" status? a. $11,044 b. $11,056 c. $8086 d. $9271

2b2t

Answers: 3

Another question on Business

Business, 22.06.2019 04:00

Match the type of agreements to their descriptions. will trust living will prenuptial agreement

Answers: 2

Business, 22.06.2019 12:50

In june 2009, at the trough of the great recession, the bureau of labor statistics announced that of all adult americans, 140,196,000 were employed, 14,729,000 were unemployed and 80,729,000 were not in the labor force. use this information to calculate: a. the adult population b. the labor force c. the labor-force participation rate d. the unemployment rate

Answers: 3

Business, 22.06.2019 14:50

One pound of material is required for each finished unit. the inventory of materials at the end of each month should equal 20% of the following month's production needs. purchases of raw materials for february would be budgeted to be:

Answers: 2

Business, 22.06.2019 23:00

How an absolute advantage might affect a country's imports and exports?

Answers: 2

You know the right answer?

Christian's taxable income last year was $59,450. according to the tax table below, how much tax doe...

Questions

Mathematics, 23.12.2020 03:10

English, 23.12.2020 03:10

Business, 23.12.2020 03:10

English, 23.12.2020 03:10

Computers and Technology, 23.12.2020 03:10

Mathematics, 23.12.2020 03:10

Business, 23.12.2020 03:10

History, 23.12.2020 03:10