Social Studies, 07.07.2019 05:30 babygirl091502

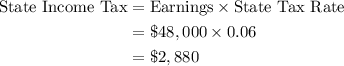

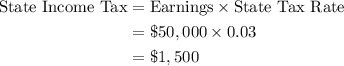

Jamal is a nurse and earns $48,000 per year. he lives in california and pays about 6 percent of his income in state income taxes. his sales tax rate is 8 percent. diamond is an accountant and earns $50,000 per year. she lives in arizona and pays about 3 percent of her income in state income taxes. her sales tax rate is 9.5 percent. jamal and diamond are calculating their taxes for the year. they both have no dependents, so their federal tax rates are the same. who would pay more in federal income taxes? who would pay more in sales taxes when making purchases?

Answers: 1

Another question on Social Studies

Social Studies, 21.06.2019 19:30

Which group directly benefits from subsidies? exporters sellers producers importers

Answers: 1

Social Studies, 22.06.2019 06:20

John locke, an enlightenment-era philosopher, influenced the american movement for independence. locke believed that all people were entitled to natural rights. which quotation from the preamble to the declaration of independence refers to natural rights?

Answers: 1

Social Studies, 22.06.2019 19:00

In the 1600s, the american colonies passed many laws that affected the rights and activities of specific groups of people. which of the following was one of these laws?slaves were defined as servants for apex

Answers: 1

You know the right answer?

Jamal is a nurse and earns $48,000 per year. he lives in california and pays about 6 percent of his...

Questions

Chemistry, 17.10.2019 00:00

Computers and Technology, 17.10.2019 00:00

Mathematics, 17.10.2019 00:00

History, 17.10.2019 00:00

Chemistry, 17.10.2019 00:00

History, 17.10.2019 00:00

Chemistry, 17.10.2019 00:00