Mathematics, 23.07.2019 05:00 kennyg02

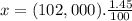

In 2009, the maximum taxable income for social security was $102,000 and the rate was 6.2%. the rate for medicare tax was 1.45%. if jessica's taxable income was $152,000 that year, how much did she pay in fica taxes?

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 20:00

The length of the line segment joining the midpoints of sides ab and bc of the parallelogram abcd is 10. find the length of diagnol ac

Answers: 3

Mathematics, 21.06.2019 23:00

According to a study conducted in 2015, 18% of shoppers said that they prefer to buy generic instead of name-brand products. suppose that in a recent sample of 1500 shoppers, 315 stated that they prefer to buy generic instead of name-brand products. at a 5% significance level, can you conclude that the proportion of all shoppers who currently prefer to buy generic instead of name-brand products is higher than .18? use both the p-value and the critical-value approaches.

Answers: 1

Mathematics, 22.06.2019 03:20

Atotal of 505 tickets were sold for a school play they were either adult tickets or student tickets they were 55 more student tickets so than adult tickets how many adult tickets were sold ?

Answers: 2

You know the right answer?

In 2009, the maximum taxable income for social security was $102,000 and the rate was 6.2%. the rate...

Questions

Mathematics, 13.01.2021 19:50

English, 13.01.2021 19:50

Biology, 13.01.2021 19:50

Mathematics, 13.01.2021 19:50

Mathematics, 13.01.2021 19:50

Arts, 13.01.2021 19:50

History, 13.01.2021 19:50

Social Studies, 13.01.2021 19:50

Mathematics, 13.01.2021 19:50

Mathematics, 13.01.2021 19:50

History, 13.01.2021 19:50

Arts, 13.01.2021 19:50