Mathematics, 27.01.2020 21:31 lordcaos066

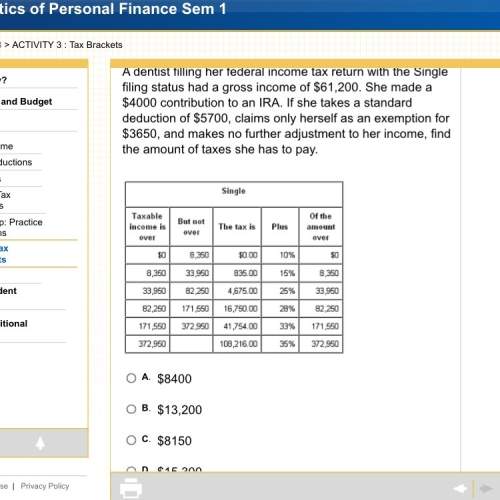

Adentist filling her federal income tax return with the single filing status had a gross income of $61,200. she made a $4000 contribution to an ira. if she takes a standard deduction of $5700, claims only herself as an exemption for $3650, and makes no further adjustment to her income, find the amount of taxes she has to pay.

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 19:30

Okay so i didn't get this problem petro bought 8 tickets to a basketball game he paid a total of $200 write an equation to determine whether each ticket cost $26 or $28 so i didn't get this question so yeahyou have a good day.

Answers: 1

Mathematics, 21.06.2019 23:00

The ratio of the perimeters of two similar triangles is 4: 3. what are the areas of these triangles if the sum of their areas is 130cm2?

Answers: 3

You know the right answer?

Adentist filling her federal income tax return with the single filing status had a gross income of $...

Questions

Mathematics, 27.11.2019 00:31

Mathematics, 27.11.2019 00:31

History, 27.11.2019 00:31

English, 27.11.2019 00:31

History, 27.11.2019 00:31

History, 27.11.2019 00:31

English, 27.11.2019 00:31

Biology, 27.11.2019 00:31