Mathematics, 27.07.2019 22:00 xbeatdroperzx

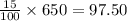

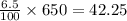

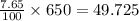

Ginny jones receives $650 gross salary biweekly. her income tax rate is 15%. her group health plan contribution is $24.50 per pay period. she belongs to the company retirement plan, to which she contributes 6.5% of her earnings. she is also covered under social security benefits. her current contribution is 7.65%. if these items are all her deductions, what is her take-home pay per period? ginny gets a $55 raise per pay period. if her health plan is unchanged, how much of the raise will she have to take home?

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 17:00

If you apply the changes below to the absolute value parent function, f(x)=\x\, which of these is the equation of the new function? shift 2 units to the left shift 3 units down a. g(x)=\x-3\-2 b. g(x)= \x-2\-3 c. g(x)= \x+3\-2 d. g(x)= \x+2\-3

Answers: 1

Mathematics, 21.06.2019 20:30

Find the solution(s) to the system of equations. select all that apply y=x^2-1 y=2x-2

Answers: 2

Mathematics, 21.06.2019 23:00

Abox holds 500 paperclips. after a week on the teacher's desk 239 paperclips remained. how many paperclips were used?

Answers: 1

Mathematics, 21.06.2019 23:10

Consider the following function. which of the following graphs corresponds to the given function? w. x. y. z. a. z b. y c. x d.

Answers: 1

You know the right answer?

Ginny jones receives $650 gross salary biweekly. her income tax rate is 15%. her group health plan c...

Questions

Mathematics, 11.11.2020 14:00

English, 11.11.2020 14:00

Physics, 11.11.2020 14:00

Mathematics, 11.11.2020 14:00

History, 11.11.2020 14:10

Mathematics, 11.11.2020 14:10

Social Studies, 11.11.2020 14:10

English, 11.11.2020 14:10

Mathematics, 11.11.2020 14:10

Chemistry, 11.11.2020 14:10

Mathematics, 11.11.2020 14:10

Mathematics, 11.11.2020 14:10

Social Studies, 11.11.2020 14:10

Geography, 11.11.2020 14:10

$

$ $

$ $

$