Mathematics, 11.11.2021 06:50 ImmortalEnigmaYT

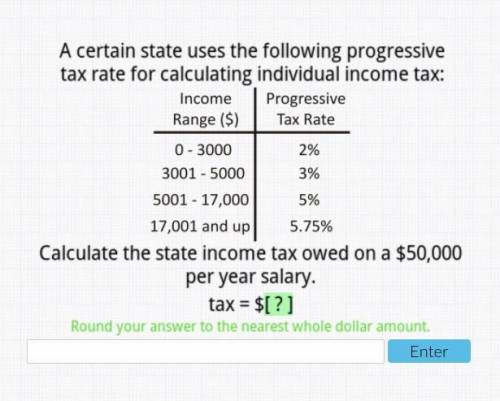

A certain state uses the following progressive tax rate for calculating individual income tax:

Income Range ($) Progressive Tax Rate

0-3000 2%

3001-5000 3%

5001-17,000 5%

17,001 and up 5.75%

Calculate the state income tax owed on a $50,000 per year salary.

tax = $[ ]

Round your answer to the nearest whole dollar amount.

*NEED HELP ASAP!*

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 19:30

Celeste wants to have her hair cut and permed and also go to lunch. she knows she will need $50. the perm cost twice as much as her haircut and she needs $5 for lunch. how much does the perm cost?

Answers: 1

Mathematics, 21.06.2019 21:00

In the field of thermodynamics, rankine is the unit used to measure temperature. one can convert temperature from celsius into rankine using the formula , what is the temperature in celsius corresponding to r degrees rankine? a. 9/5(c - 273) b. 9/5(c + 273) c. 5/9( c - 273) d. 5/9( c + 273)

Answers: 1

You know the right answer?

A certain state uses the following progressive tax rate for calculating individual income tax:

Inc...

Questions

Mathematics, 26.05.2021 03:10

Health, 26.05.2021 03:10

Mathematics, 26.05.2021 03:10

Mathematics, 26.05.2021 03:10

Mathematics, 26.05.2021 03:10

Mathematics, 26.05.2021 03:10

Computers and Technology, 26.05.2021 03:10

Mathematics, 26.05.2021 03:10

Mathematics, 26.05.2021 03:10