Mathematics, 06.10.2021 08:30 kdobi

Heavy Metal Corporation is expected to generate the following free cash flows over the next five years:

Year. 1 2 3 4 5

FCF ($ million) 53.7 67.3 78.9 75.6 81.3

Thereafter, the free cash flows are expected to grow at the industry average of 4.3% per year. Using the discounted free cash flow model and a weighted average cost of capital of 13.9%:

a. Estimate the enterprise value of Heavy Metal.

b. If Heavy Metal has no excess cash, debt of $313 million, and 45 million shares outstanding, estimate its share price.

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 17:30

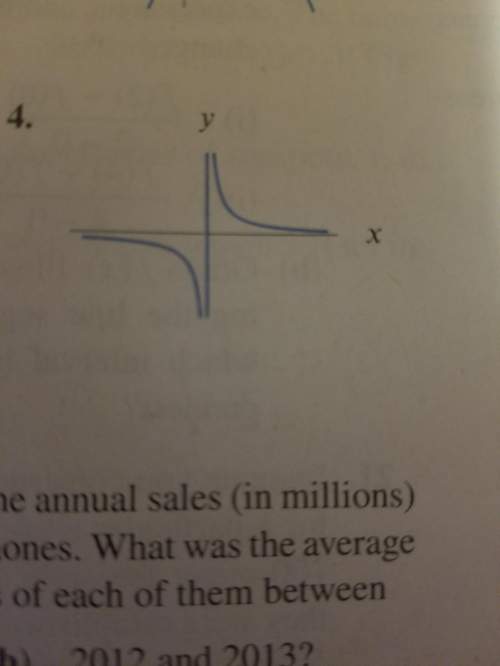

Which of the following tables represents exponential functions?

Answers: 1

Mathematics, 21.06.2019 20:30

Which equation expression the relationship between the number of boxes b and the number of cans c and the proportion is 48

Answers: 1

Mathematics, 22.06.2019 01:30

The box plots show the distributions of the numbers of words per line in an essay printed in two different fonts.which measure of center would be best to compare the data sets? the median is the best measure because both distributions are left-skewed.the mean is the best measure because both distributions are left-skewed.the median is the best measure because both distributions are symmetric.the mean is the best measure because both distributions are symmetric

Answers: 1

Mathematics, 22.06.2019 05:30

Amap of british columbia has a scale of 1: 1 723 000. the distance on the map between prince george and cache creek is 8 11/16 in. what is this distance to the nearest mile

Answers: 2

You know the right answer?

Heavy Metal Corporation is expected to generate the following free cash flows over the next five yea...

Questions

Mathematics, 14.12.2021 04:10

Social Studies, 14.12.2021 04:10

SAT, 14.12.2021 04:10

SAT, 14.12.2021 04:10

SAT, 14.12.2021 04:10