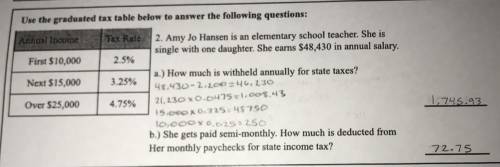

Person Exemption-

Single: $1,500

(Graduate State Income Taxes)

...

Mathematics, 24.09.2021 07:00 piper64bsj

Person Exemption-

Single: $1,500

(Graduate State Income Taxes)

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 14:30

Find the balance at the end of 4 years if 1000 is deposited at the rate of

Answers: 1

Mathematics, 21.06.2019 15:00

What are the relative frequencies to the nearest hundredth of the columns of the two-way table? a b group 1 102 34 group 2 18 14

Answers: 1

Mathematics, 21.06.2019 21:30

Questions 7-8. use the following table to answer. year 2006 2007 2008 2009 2010 2011 2012 2013 cpi 201.6 207.342 215.303 214.537 218.056 224.939 229.594 232.957 7. suppose you bought a house in 2006 for $120,000. use the table above to calculate the 2013 value adjusted for inflation. (round to the nearest whole number) 8. suppose you bought a house in 2013 for $90,000. use the table above to calculate the 2006 value adjusted for inflation. (round to the nearest whole number)

Answers: 3

Mathematics, 22.06.2019 00:10

Which of these would have been most likely to have been a carpetbagger during the reconstruction era? a) a new york businessman who relocated to mississippi b) a former slave who was able to buy land in birmingham c) a carolina-born politician who supported the democratic d) a former confederate officer who owned a farm in memphis eliminate

Answers: 1

You know the right answer?

Questions

Social Studies, 25.07.2019 03:00

English, 25.07.2019 03:00

Biology, 25.07.2019 03:00

English, 25.07.2019 03:00

Health, 25.07.2019 03:00

Mathematics, 25.07.2019 03:00

Mathematics, 25.07.2019 03:00

Arts, 25.07.2019 03:00

History, 25.07.2019 03:00

Chemistry, 25.07.2019 03:00

History, 25.07.2019 03:00

History, 25.07.2019 03:00

Mathematics, 25.07.2019 03:00