Mathematics, 23.09.2021 09:30 lildanielmabien

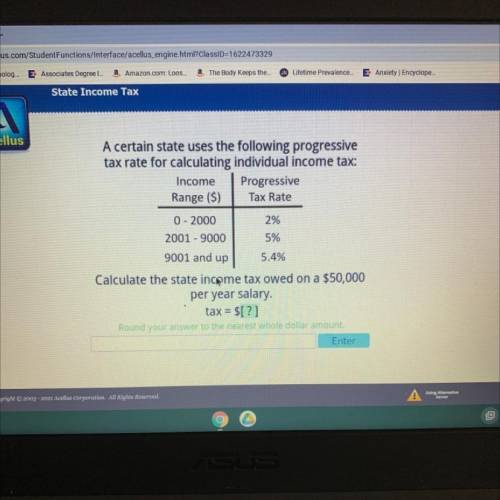

A certain state uses the following progressive

tax rate for calculating individual income tax:

Income Progressive

Range ($) Tax Rate

0 - 2000

2%

2001 - 9000 5%

9001 and up 5.4%

Calculate the state income tax owed on a $50,000

per year salary.

tax = $[?]

Round your answer to the nearest whole dollar amount,

Enter

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 17:50

Adriana sold 50 shares of a company’s stock through a broker. the price per share on that day was $22.98. the broker charged her a 0.75% commission. what was adriana’s real return after deducting the broker’s commission? a. $8.62 b. $229.80 c. $1,140.38 d. $1,149.00

Answers: 1

Mathematics, 21.06.2019 19:10

The triangles in the diagram are congruent. if mzf = 40°, mza = 80°, and mzg = 60°, what is mzb?

Answers: 2

Mathematics, 21.06.2019 19:30

Hey am have account in but wished to create an account here you guys will me with my make new friends of uk !

Answers: 1

Mathematics, 21.06.2019 19:30

Solve for x and y: 217x + 131y = 913; 131x + 217y = 827

Answers: 1

You know the right answer?

A certain state uses the following progressive

tax rate for calculating individual income tax:

Questions

History, 28.01.2020 00:31

Physics, 28.01.2020 00:31

Mathematics, 28.01.2020 00:31

Mathematics, 28.01.2020 00:31

Mathematics, 28.01.2020 00:31

History, 28.01.2020 00:31