Mathematics, 22.09.2021 23:10 wananikwecurley99

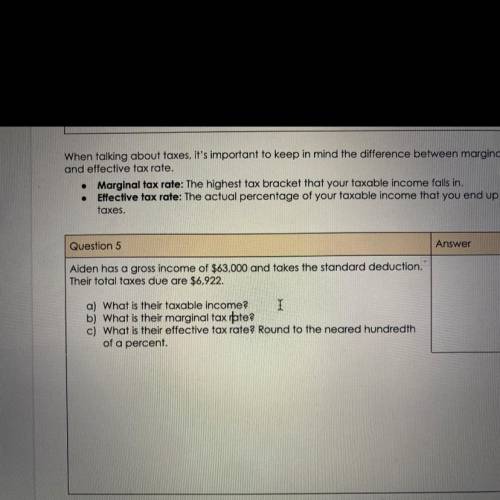

Aiden has a gross income of $63,000 and takes the standard deduction.

Their total taxes due are $6,922.

a) What is their taxable income?

b) What is their marginal tax rate?

c) What is their effective tax rate? Round to the neared hundredth

of a percent.

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 22:30

Gabrielle's age is two times mikhail's age. the sum of their ages is 84. what is mikhail's age?

Answers: 2

Mathematics, 21.06.2019 23:00

What adds to be the bottom number but also multiplies to be the top number with 8 on the bottom and 15 on top

Answers: 2

Mathematics, 22.06.2019 01:00

The dance committee of pine bluff middle school earns $72 from a bake sale and will earn $4 for each ticket they sell to the spring fling dance. the dance will cost $400 write an inequality to determine the number, t of tickets the committee could sell to have money left over after they pay for this year's dance. what is the solution set of the inequality?

Answers: 2

You know the right answer?

Aiden has a gross income of $63,000 and takes the standard deduction.

Their total taxes due are $6...

Questions

Biology, 12.12.2020 15:50

Mathematics, 12.12.2020 15:50

Mathematics, 12.12.2020 15:50

Mathematics, 12.12.2020 15:50

Mathematics, 12.12.2020 15:50

Mathematics, 12.12.2020 15:50

Mathematics, 12.12.2020 15:50

Chemistry, 12.12.2020 15:50

Mathematics, 12.12.2020 15:50

English, 12.12.2020 15:50