Mathematics, 10.09.2021 14:00 mremoney530

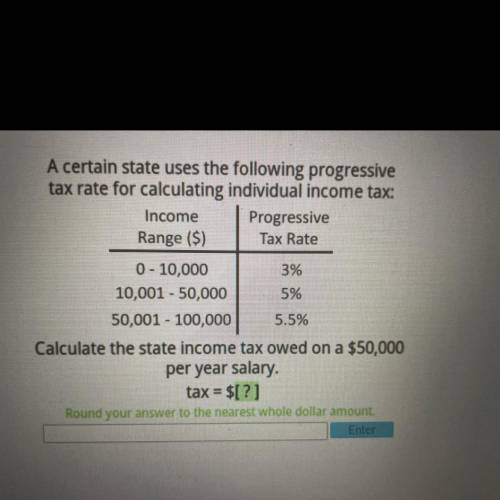

A certain state uses the following progressive

tax rate for calculating individual income tax:

Income Progressive

Range ($) Tax Rate

0 - 10,000

3%

10,001 - 50,000 5%

50,001 - 100,000 5.5%

Calculate the state income tax owed on a $50,000

per year salary.

tax = $[?]

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 23:30

The triangle shown has a hypotenuse with a length of 13 feet. the measure of angle a is 20 degrees. and the measure of angle b is 70 degrees. which of the following is closest to the length, in feet, of line segment ac? no need to use a calculator to find the trig numbers. each function is listed below. 4.4 5 12.2 35.7

Answers: 2

Mathematics, 22.06.2019 00:00

Mila's dog weighs 4 pounds more than 8 times the weight of keiko's dog. which expression could be used to fine te weight of mila's dog?

Answers: 2

Mathematics, 22.06.2019 02:00

Pleasseee important quick note: enter your answer and show all the steps that you use to solve this problem in the space provided. use the circle graph shown below to answer the question. a pie chart labeled favorite sports to watch is divided into three portions. football represents 42 percent, baseball represents 33 percent, and soccer represents 25 percent. if 210 people said football was their favorite sport to watch, how many people were surveyed?

Answers: 1

You know the right answer?

A certain state uses the following progressive

tax rate for calculating individual income tax:

Questions

History, 20.04.2021 21:10

Social Studies, 20.04.2021 21:10

Social Studies, 20.04.2021 21:10

English, 20.04.2021 21:10

Biology, 20.04.2021 21:10

Spanish, 20.04.2021 21:10

History, 20.04.2021 21:10

Mathematics, 20.04.2021 21:10

Mathematics, 20.04.2021 21:10

Computers and Technology, 20.04.2021 21:10

History, 20.04.2021 21:10

History, 20.04.2021 21:10

Engineering, 20.04.2021 21:10