Mathematics, 17.08.2021 21:20 jennaranelli05

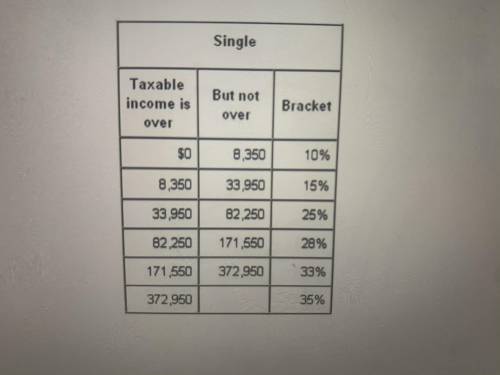

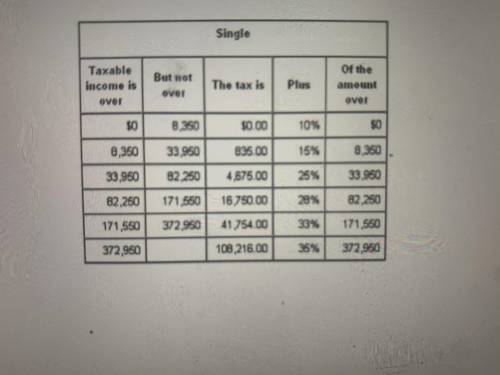

Monica is an unmarried college student with no dependents. Last year, she made $14,000 working part time as a medical assistant. Each year she filed taxes as Single, takes a standard deduction of $5700 and claims herself as only exemption for $3650. Based on this information, what tax bracket does Monica fall into? (First picture) Using the information from a previous problem, calculate the amount of taxes Monica owes. (Second picture)

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 20:00

Beth divided 9 ounces of her granola recipe into 4 equal-sized amounts. she placed the amounts into individual bowls. the fraction 9/4 represents the number of ounces of granola in each bowl. which other number represents the amount of granola beth has in each bowl? (a) 1 1/4 (b) 2 1/4 (c) 1 3/4 (d) 3 3/4 i need !

Answers: 2

Mathematics, 21.06.2019 20:30

Arectangle has a width of 5 cm and a length of 10 cm. if the width is increased by 3, how does the perimeter change?

Answers: 1

You know the right answer?

Monica is an unmarried college student with no dependents. Last year, she made $14,000 working part...

Questions

English, 20.02.2020 03:08

Social Studies, 20.02.2020 03:08

Biology, 20.02.2020 03:09

Mathematics, 20.02.2020 03:09