Mathematics, 31.07.2021 19:40 Madisonk3571

HIGH POINTS + BRAINLIEST

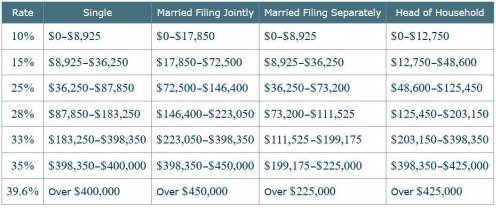

Each row shows the tax rate on a specific portion of the taxpayer's taxable income given their filing status. For example, suppose a taxpayer has a filing status of Single and a taxable income of $40,000. This means that the taxpayer owes 10% tax on the first $8,925, 15% tax on the amount over $8,925 up to $36,250, and 25% in the amount over $36,250 up to $ 40,000.

If Abdul and Maria had a filing status of Married Filing Jointly and together have a taxable income of $91,307 in the year 2013, how much did the couple owe for federal income tax?

Do not round any intermediate computations. Round your answer to the nearest dollar.

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 17:00

In triangle opq right angled at p op=7cm,oq-pq=1 determine the values of sinq and cosq

Answers: 1

Mathematics, 21.06.2019 18:00

What is the location of point g, which partitions the directed line segment from d to f into a 5: 4 ratio? –1 0 2 3

Answers: 1

Mathematics, 21.06.2019 21:30

Three people are traveling and need to exchange the currency of their native country for the currency of the country they are visiting. drag each exchange to the category that shows the ratio of currencies in that exchange.

Answers: 2

Mathematics, 21.06.2019 22:00

In the sixth grade 13 out of 20 students have a dog if there are 152 sixth grade students how many of them have a dog

Answers: 2

You know the right answer?

HIGH POINTS + BRAINLIEST

Each row shows the tax rate on a specific portion of the taxpayer's taxabl...

Questions

Mathematics, 05.07.2021 01:00

Mathematics, 05.07.2021 01:00

English, 05.07.2021 01:00

History, 05.07.2021 01:00

Mathematics, 05.07.2021 01:00

Computers and Technology, 05.07.2021 01:00

Mathematics, 05.07.2021 01:00

Mathematics, 05.07.2021 01:00

Mathematics, 05.07.2021 01:00

Arts, 05.07.2021 01:00