Mathematics, 26.06.2021 23:00 caitlin89

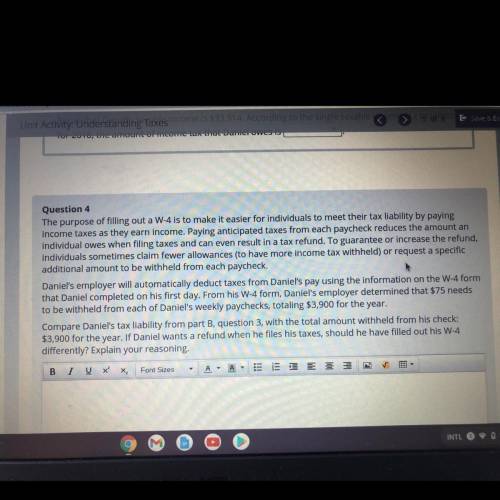

The purpose of filling out a W-4 is to make it easier for individuals to meet their tax liability by paying

income taxes as they earn income. Paying anticipated taxes from each paycheck reduces the amount an

individual owes when filing taxes and can even result in a tax refund. To guarantee or increase the refund,

individuals sometimes claim fewer allowances (to have more income tax withheld) or request a specific

additional amount to be withheld from each paycheck.

Daniel's employer will automatically deduct taxes from Daniel's pay using the information on the W-4 form

that Daniel completed on his first day. From his W-4 form, Daniel's employer determined that $75 needs

to be withheld from each of Daniel's weekly paychecks, totaling $3,900 for the year.

Compare Daniel's tax liability from part B, question 3, with the total amount withheld from his check:

$3,900 for the year. If Daniel wants a refund when he files his taxes, should he have filled out his W-4

differently? Explain your reasoning,

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 17:00

What properties allow transformation to be used as a problem solving tool

Answers: 1

Mathematics, 21.06.2019 19:50

If the scale factor between two circles is 2x/5y what is the ratio of their areas?

Answers: 3

Mathematics, 21.06.2019 21:00

Deepak plotted these points on the number line. point a: –0.3 point b: – 3 4 point c: – 11 4 point d: –0.7 which point did he plot incorrectly?

Answers: 2

Mathematics, 21.06.2019 22:00

If you have 12 feet of string and you cut it into equal length of 5 inches each how much string will be left

Answers: 2

You know the right answer?

The purpose of filling out a W-4 is to make it easier for individuals to meet their tax liability by...

Questions

Computers and Technology, 06.07.2021 17:10

Social Studies, 06.07.2021 17:10

Mathematics, 06.07.2021 17:10

English, 06.07.2021 17:10

Mathematics, 06.07.2021 17:20

Mathematics, 06.07.2021 17:20

Mathematics, 06.07.2021 17:20

Mathematics, 06.07.2021 17:20

Mathematics, 06.07.2021 17:20

Mathematics, 06.07.2021 17:20