Mathematics, 20.06.2021 21:30 joe7977

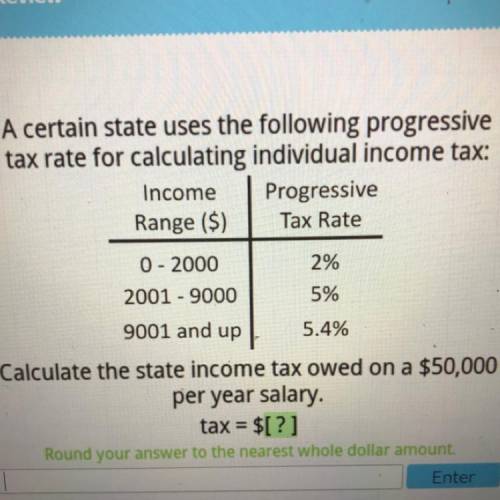

A certain state uses the following progressive

tax rate for calculating individual income tax:

Income Progressive

Range ($) Tax Rate

0 - 2000

2%

2001 - 9000

5%

9001 and up

5.4%

Calculate the state income tax owed on a $50,000

per year salary.

tax = $[?]

Round your answer to the nearest whole dollar amount.

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 19:00

The fraction 7/9 is equivalent to a percent that is greater than 100%. truefalse

Answers: 1

Mathematics, 21.06.2019 19:30

Solve for x and y: 217x + 131y = 913; 131x + 217y = 827

Answers: 1

Mathematics, 22.06.2019 03:00

Which point on the scatter plot is an outlier? a scatter plot is show. point m is located at 3 and 3, point p is located at 5 and 5, point n is located at 5 and 7, point l is located at 6 and 2. additional points are located at 1 and 3, 2 and 3, 2 and 4, 3 and 4, 3 and 5, 4 and 5, 4 and 6, 5 and 6. point p point n point m point l

Answers: 3

Mathematics, 22.06.2019 04:00

What is the answer to this equation? and if you can, find a way to show your work.

Answers: 2

You know the right answer?

A certain state uses the following progressive

tax rate for calculating individual income tax:

Questions

Mathematics, 30.12.2020 14:00

English, 30.12.2020 14:00

Mathematics, 30.12.2020 14:00

Mathematics, 30.12.2020 14:00

Mathematics, 30.12.2020 14:00

Mathematics, 30.12.2020 14:00

Mathematics, 30.12.2020 14:00

Chemistry, 30.12.2020 14:00

Social Studies, 30.12.2020 14:00

Biology, 30.12.2020 14:00

English, 30.12.2020 14:00

History, 30.12.2020 14:00

History, 30.12.2020 14:00

Mathematics, 30.12.2020 14:00