Mathematics, 17.05.2021 16:30 evazquez

Artan Industries currently has total capital equal to $6 million, has zero debt, is in the 40% federal-plus-state tax bracket, has a net income of $4 million, and distributes 40% of its earnings as dividends. Net income is expected to grow at a constant rate of 3% per year, 230,000 shares of stock are outstanding, and the current WACC is 12.00%. The company is considering a recapitalization where it will issue $2 million in debt and use the proceeds to repurchase stock. Investment bankers have estimated that if the company goes through with the recapitalization, its before-tax cost of debt will be 9% and its cost of equity will rise to 14.5%

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 18:30

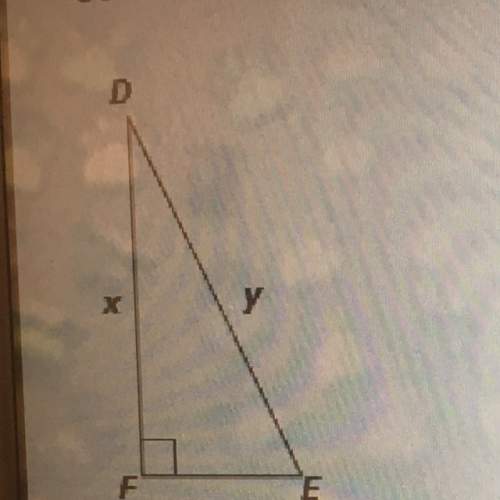

Iwill give ! if m∠a=59 and m∠3=81°, what is m∠b? m∠b= _[blank]_°

Answers: 2

Mathematics, 21.06.2019 18:40

What value of x is in the solution set of 4x – 12 s 16 + 8x?

Answers: 3

Mathematics, 22.06.2019 01:00

If log(a) = 1.2 and log(b)= 5.6, what is log(a/b)? a. 4.4b. 6.8c. not enough informationd. -4.4

Answers: 1

You know the right answer?

Artan Industries currently has total capital equal to $6 million, has zero debt, is in the 40% feder...

Questions

Mathematics, 24.04.2020 20:58

Mathematics, 24.04.2020 20:58

Mathematics, 24.04.2020 20:58

Mathematics, 24.04.2020 20:58

Spanish, 24.04.2020 20:58