(PLEASE HELP I I REALLY NEED IT)

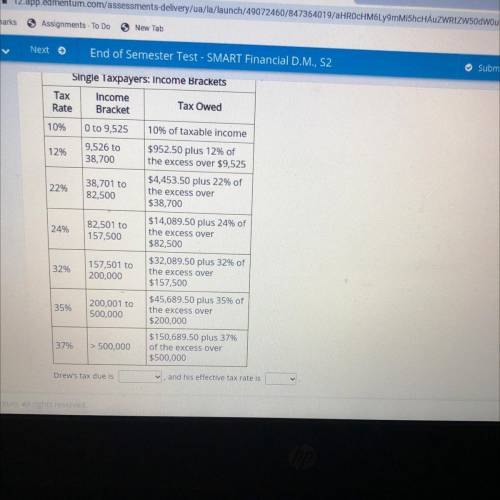

Select the correct answer from each drop-down menu.

Drew is...

Mathematics, 13.05.2021 08:00 alexisgonzales4752

(PLEASE HELP I I REALLY NEED IT)

Select the correct answer from each drop-down menu.

Drew is filing his tax return as single taxpayer. His taxable income is $39,000. Use the tax table provided to compute Drew's tax due and effective

tax rate.

1st drop down numbers are:

$4,519.50

$4,680.00

$5,525.25

$8,580.00

2nd drop down numbers are for the tax rate:

11.6%

12.0%

14.2%

22.0%

Answers: 3

Another question on Mathematics

Mathematics, 20.06.2019 18:02

There are 96 raisins and 24 cashews in each package of granola. what is the unit rate in raisins per cashew? plz 4122096

Answers: 1

Mathematics, 22.06.2019 03:10

Aregular hexagonal pyramid has a base area of 45 in2 and a lateral area of 135in 2. what is the surface are are of the regular hexagonal pyramid

Answers: 2

Mathematics, 22.06.2019 04:00

Michael and imani go out to eat for lunch if their food and beverages cost 25.30 and there is an 8% meals tax how much is the bill

Answers: 1

You know the right answer?

Questions

Mathematics, 20.05.2021 21:50

Mathematics, 20.05.2021 21:50

Mathematics, 20.05.2021 21:50

Mathematics, 20.05.2021 21:50

Mathematics, 20.05.2021 21:50

English, 20.05.2021 21:50

Chemistry, 20.05.2021 21:50

Geography, 20.05.2021 21:50

Mathematics, 20.05.2021 21:50

Mathematics, 20.05.2021 21:50

Arts, 20.05.2021 21:50