Mathematics, 08.05.2021 03:10 emileehogan

Julio has a gross yearly income of $57,116. Suppose he pays 20% in federal and state taxes, puts

aside 10% of his gross income to pay off his school loan, and puts 15% of his gross income aside for

retirement investing. If he is considering an apartment that costs $800 per month, how much would

he have left each month after paying taxes, his loan payment, his rent, and putting aside some

money into savings? Round to the nearest dollar.

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 21:30

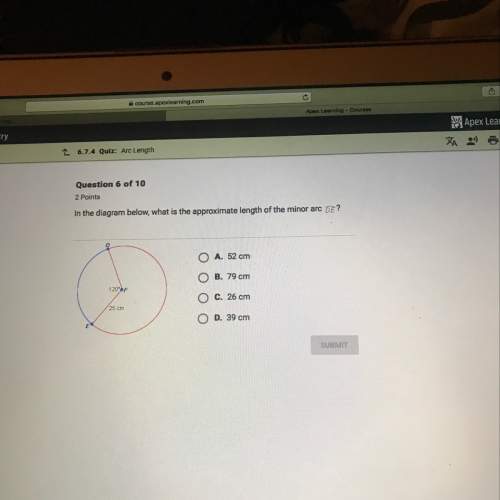

Look at triangle wxy what is the length (in centimeters) of the side wy of the triangle?

Answers: 2

Mathematics, 21.06.2019 21:50

(x-5)1/2+5=2 what is possible solution of this equation

Answers: 1

Mathematics, 22.06.2019 00:00

Which is a logical conclusion based on the given information? a. figure abcd is a rhombus by the definition of a rhombus. b. segment ac is congruent to segment dc by cpctc. c. angle acb is congruent to angle adc by the angle-side-angle theorem. d. triangle acd is congruent to triangle cab by the hypotenuse-leg theorem.

Answers: 1

Mathematics, 22.06.2019 00:10

Use your knowledge of the binary number system to write each binary number as a decimal number. a) 1001 base 2= base 10 b) 1101 base 2 = base 10

Answers: 1

You know the right answer?

Julio has a gross yearly income of $57,116. Suppose he pays 20% in federal and state taxes, puts

a...

Questions

Mathematics, 05.08.2019 03:10

Mathematics, 05.08.2019 03:10

English, 05.08.2019 03:10

Health, 05.08.2019 03:10

Spanish, 05.08.2019 03:10

Mathematics, 05.08.2019 03:10

Mathematics, 05.08.2019 03:10

Mathematics, 05.08.2019 03:10

History, 05.08.2019 03:10

Advanced Placement (AP), 05.08.2019 03:10