Mathematics, 24.04.2021 23:20 deasia45

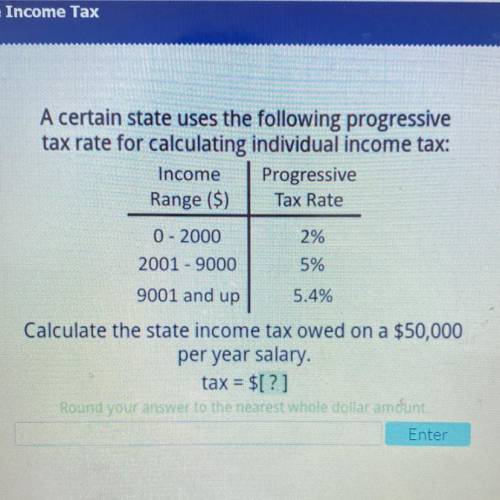

A certain state uses the following progressive

tax rate for calculating individual income tax:

Income Progressive

Range ($) Tax Rate

0 - 2000

2%

2001 - 9000 5%

9001 and up 5.4%

Calculate the state income tax owed on a $50,000

per year salary.

tax = $[?]

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 13:10

When eating out, record the total cost of your meal (before tip) and the tip that you left. determine the percent of the cost of the meal that you left as a tip.

Answers: 1

Mathematics, 21.06.2019 17:30

25 ! the line of best fit is h = 5a + 86. predict the height at age 16.

Answers: 2

Mathematics, 21.06.2019 21:30

Olive's solar powered scooter travels at a rate of 30 miles per hour. what equation can she use to calculate her distance with relation to the time she traveled? h=hours m=miles 1. h=m+30 2. m=30h 3. m=h+30 4. h=30m

Answers: 2

You know the right answer?

A certain state uses the following progressive

tax rate for calculating individual income tax:

Questions

Mathematics, 12.03.2021 21:40

Mathematics, 12.03.2021 21:50

Mathematics, 12.03.2021 21:50

Mathematics, 12.03.2021 21:50

Mathematics, 12.03.2021 21:50

Chemistry, 12.03.2021 21:50

Social Studies, 12.03.2021 21:50

Advanced Placement (AP), 12.03.2021 21:50

English, 12.03.2021 21:50